Ronan Duran Health Insurance in Darlington South Carolina

6 reviews

6 reviews

Select a product to get a quote

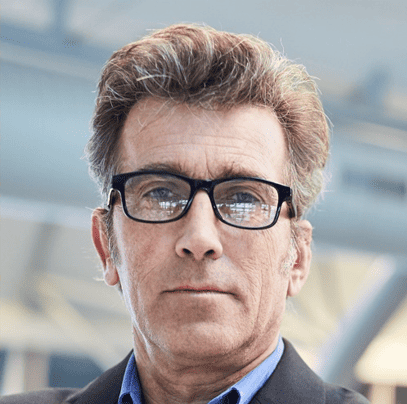

Local ApexInsurance Agent: Meet Ronan Duran Health Insurance in Darlington South Carolina

Ronan Duran: Your Darlington, SC Health Insurance Expert

Personalized Service: At Ronan Duran Health Insurance, we believe in providing personalized attention to each client. We take the time to understand your unique needs, health history, and financial situation to recommend the best health insurance plan for you. We’re not just selling policies; we’re building relationships.

Local Expertise: Ronan Duran has extensive knowledge of the Darlington, SC, healthcare landscape. We’re deeply familiar with local providers, hospitals, and the specific health insurance options available in the community, ensuring you receive a plan that seamlessly fits your lifestyle.

Comprehensive Guidance: We guide you through the complex world of health insurance, explaining the different plan types, cost considerations, and enrollment processes in clear, straightforward terms. We’ll help you decipher the jargon and navigate the paperwork, so you can focus on what matters most: your health.

Advocacy and Support: When you need it most, we’re here for you. We’ll advocate on your behalf with insurance companies, helping you resolve disputes and ensure you receive the coverage you deserve. We provide ongoing support throughout the year, not just during the initial enrollment process.

Competitive Rates: We work with multiple insurance providers to secure the best possible rates for our clients. We diligently search for plans that offer the ideal balance of coverage and affordability. We’re dedicated to helping you find the most cost-effective plan without compromising on quality coverage.

Comprehensive Plan Options: We offer a wide array of health insurance plans from leading providers, encompassing HMOs, PPOs, EPOs, and other options to accommodate diverse needs and preferences. We present a customized selection of plans tailored to your specific circumstances, enabling you to make a truly informed choice.

Community Commitment: Ronan Duran is deeply committed to the Darlington community. We’re proud to serve our neighbors, providing the trusted guidance and support they need to navigate the healthcare system. We’re invested in the well-being of our community and dedicated to ensuring everyone has access to affordable, quality healthcare.

Why Choose Us?

In a world of confusing health insurance options, Ronan Duran provides clear, concise, and personalized guidance. We simplify the process, making it easier for you to find the best health insurance plan for your individual needs. We’re more than just insurance agents; we’re your trusted healthcare partners.

Products we offer:

Recent reviews

Our team

Ronan Duran

Insurance AgentRonan is a highly experienced and knowledgeable insurance agent specializing in health insurance. He possesses a deep understanding of the industry and a strong commitment to client satisfaction. His expertise and personalized approach make him a valuable asset to the community.

Maria Rodriguez

Client Services ManagerMaria is the Client Services Manager, responsible for ensuring a seamless and efficient experience for all clients. Her dedication to excellent client service and her organizational skills make her an invaluable member of the team.

David Lee

Claims SpecialistDavid is our Claims Specialist, providing expert assistance to clients throughout the claims process. His extensive knowledge of claims procedures and his dedication to ensuring clients receive the coverage they are entitled to are invaluable assets to our agency.

Frequently asked questions

Ronan Duran Health Insurance in Darlington, South Carolina: Your Comprehensive Guide

Understanding Your Health Insurance Needs in Darlington, SC

Finding the right health insurance can feel overwhelming. With so many plans and providers, how do you ensure you’re getting the coverage you need at a price you can afford? This comprehensive guide will walk you through the process of selecting the best health insurance in Darlington, South Carolina, focusing on the expertise of Ronan Duran and the resources available to you. We’ll explore various plan types, key considerations, and frequently asked questions to empower you to make informed decisions about your health and financial well-being.

Navigating the Maze of Health Insurance Plans

The health insurance landscape is complex. Understanding the differences between HMOs, PPOs, and EPOs is crucial. An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician (PCP) within the network, who then refers you to specialists. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see out-of-network providers, although at a higher cost. EPOs (Exclusive Provider Organizations) are similar to HMOs, but usually don’t allow out-of-network care, except in emergency situations. We’ll delve into the specifics of each plan type, helping you determine which best suits your individual needs and healthcare preferences. Consider your healthcare history, anticipated future needs, and budget constraints as you weigh these options. The right plan will balance cost and access to the care you need.

Choosing the Right Plan Based on Your Needs

Your ideal health insurance plan isn’t a one-size-fits-all solution. Factors like your age, health status, and family situation significantly influence your choice. For example, if you have pre-existing conditions, you’ll want to ensure the plan adequately covers those. If you anticipate needing frequent specialist visits, a PPO might offer more flexibility than an HMO. Understanding these nuances allows you to make a truly informed decision. We’ll discuss how to analyze your healthcare usage patterns and project your future needs to select the most appropriate and cost-effective plan.

Finding the Right Health Insurance Provider in Darlington, SC

Once you understand the different plan types, the next step is finding a reputable provider. This section will explore the benefits of working with a local agent like Ronan Duran, who possesses in-depth knowledge of the Darlington, SC, market. This local expertise is invaluable, ensuring you receive personalized guidance tailored to the specific needs and complexities of your community.

The Advantages of Working with a Local Agent

Local agents often build strong relationships with their clients, providing personalized service that extends beyond simple policy selection. They act as advocates, helping you navigate complex claims processes and ensuring you’re getting the most out of your coverage. Their understanding of local healthcare providers and facilities is a significant advantage when selecting a plan that aligns with your preferred medical network. You’ll gain a valuable partner to guide you through the often confusing world of health insurance. This personalized support can significantly reduce stress and ensure you make the right choices.

Ronan Duran: Your Trusted Health Insurance Partner in Darlington

Ronan Duran brings years of experience and expertise to the Darlington community. His commitment to client satisfaction is evident in his personalized approach to insurance planning. He understands the unique healthcare needs of the Darlington area and works diligently to match clients with the plans that best meet their individual circumstances. His in-depth knowledge of available plans and providers allows him to offer tailored recommendations, simplifying a process that can often be daunting. Choosing a local agent ensures you have access to this level of personal support, which is crucial in navigating the complexities of health insurance.

Key Considerations When Choosing Health Insurance

Beyond plan types and providers, there are several critical factors to consider. We’ll delve into these key aspects to help you make a truly informed decision.

Premiums, Deductibles, and Co-pays: Understanding the Costs

Understanding the financial aspects of health insurance is paramount. Premiums are your monthly payments for coverage. The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Co-pays are fixed amounts you pay for doctor visits or other services. It’s crucial to carefully compare these costs across different plans to find the most financially viable option that still provides sufficient coverage. Remember to factor in potential out-of-pocket expenses, such as prescription costs, which can significantly impact your overall healthcare budget.

Network Providers and Access to Care

Another important consideration is the plan’s network of providers. Ensure that your preferred doctors and specialists are included in the network. If not, you may face higher costs or limited access to care. Research the network thoroughly and confirm that your healthcare needs will be met within the plan’s limitations. This is crucial for maintaining your existing healthcare relationships and minimizing disruptions to your routine care.

Frequently Asked Questions (FAQs)

This section addresses common questions and concerns surrounding health insurance.

**What is the best health insurance plan for me?**

The best plan depends on your individual needs, health status, and budget. Consider your healthcare history, anticipated needs, and the network of providers. Consult with a local agent like Ronan Duran for personalized guidance.

**How do I enroll in a health insurance plan?**

Enrollment periods vary depending on the plan and your eligibility. You can often enroll through the HealthCare.gov marketplace or directly with an insurance provider. Contact Ronan Duran for assistance with the enrollment process.

**What if I have a pre-existing condition?**

The Affordable Care Act (ACA) prohibits insurers from denying coverage based on pre-existing conditions. However, premiums may vary depending on your health status. Consult a local agent to clarify your options.

**How can I reduce my out-of-pocket costs?**

Several strategies can help lower costs, including selecting a plan with a lower deductible or exploring cost-sharing options. Contact Ronan Duran for guidance.

**What if I lose my job and need to change my health insurance?**

You may qualify for COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage for a period of time, allowing you to maintain your current plan temporarily. Talk to your former employer and Ronan Duran to understand your options.

Conclusion

Selecting the right health insurance is a critical decision, and having a knowledgeable and trustworthy advisor like Ronan Duran by your side can make all the difference. By understanding your needs, comparing different plans, and carefully weighing the costs and benefits, you can confidently choose a health insurance plan that protects your well-being and financial stability.