Nehemiah Martinez Health Insurance In Troy New York: Affordable Plans & Quotes

10 reviews

10 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Nehemiah Martinez Health Insurance In Troy New York: Affordable Plans & Quotes

Nehemiah Martinez: Your Trusted Health Insurance Advisor in Troy, NY

In the bustling city of Troy, New York, navigating the complexities of health insurance can feel like traversing a labyrinth. But with Nehemiah Martinez by your side, you’ll find the journey surprisingly smooth and straightforward. Nehemiah is not just an insurance agent; he’s your dedicated guide, providing personalized service and expert advice to ensure you secure the best health coverage for your individual needs and budget.

Unparalleled Expertise and Personalized Service

With years of experience in the health insurance industry, Nehemiah possesses an in-depth understanding of the various plans, options, and regulations governing healthcare coverage in New York State. He doesn’t just sell policies; he builds relationships. He takes the time to listen to your concerns, understand your health status and financial situation, and then craft a customized plan that fits your unique circumstances perfectly. This personalized approach sets him apart from generic, one-size-fits-all insurance providers.

Navigating the Complexities of Health Insurance

Understanding HMOs, PPOs, EPOs, and all the other insurance jargon can be daunting. Nehemiah simplifies the process, explaining complex terms in clear, concise language. He breaks down the differences between various plans, highlighting the pros and cons of each, ensuring you make an informed decision. He’ll clarify the intricacies of deductibles, co-pays, premiums, and out-of-pocket maximums, empowering you to choose the plan that best aligns with your financial capabilities and health requirements.

Local Knowledge for Local Needs

Nehemiah’s deep understanding of the Troy, NY healthcare landscape is a significant advantage. He has extensive knowledge of local providers, hospitals, and networks, enabling him to recommend plans with convenient access to doctors and specialists you trust. This local expertise ensures you’re not just getting insurance; you’re getting seamless access to quality healthcare within your community.

A Commitment to Ongoing Support

Nehemiah’s service doesn’t end with the sale. He’s committed to being your long-term partner in healthcare, providing ongoing support and guidance throughout the year. He’s readily available to answer your questions, assist with claims, and help you navigate any challenges that may arise. This dedication to client satisfaction builds trust and ensures a smooth, worry-free experience.

Contact Nehemiah Today

Choosing the right health insurance is a critical decision. Don’t navigate this complex process alone. Contact Nehemiah Martinez today for a personalized consultation. He’ll be your trusted advisor, ensuring you find the perfect health insurance plan to protect your well-being and financial future. Let him help you navigate the complexities of healthcare coverage and find a plan that fits your needs and budget perfectly.

Products we offer:

Recent reviews

Our team

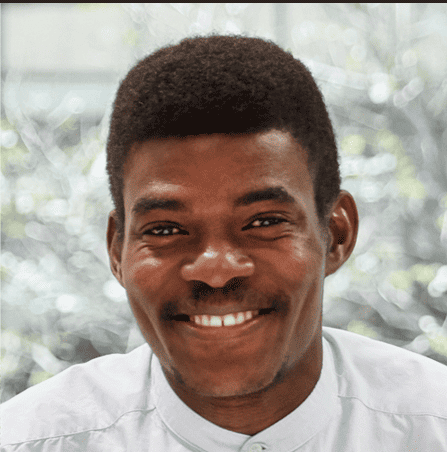

Nehemiah Martinez

Lead Insurance AgentWith over 8 years of experience, Nehemiah is a highly skilled and dedicated insurance professional. He specializes in finding the perfect health insurance plan for individuals and families in the Troy, NY area. His commitment to personalized service and comprehensive knowledge of health insurance options makes him an invaluable resource for those seeking affordable and comprehensive healthcare coverage.

Sarah Miller

Client Relations ManagerSarah ensures a seamless and positive experience for every client. She handles client inquiries, schedules appointments, and coordinates all aspects of client communication, ensuring a smooth and efficient process.

David Lee

Claims SpecialistDavid is an expert in handling insurance claims, providing support to clients and ensuring the timely processing of their healthcare claims. His experience and attention to detail provide peace of mind for clients.

Frequently asked questions

Nehemiah Martinez Health Insurance in Troy, New York offers comprehensive healthcare protection to residents of the Capital Region. Finding the right health plan can be challenging, especially navigating the complexities of coverage, premiums, and deductibles. This is why securing affordable and reliable medical coverage is crucial, and ApexInsuranceUsa understands this need.

This guide dives deep into Nehemiah Martinez’s insurance services in Troy, NY, exploring a range of health plans to fit individual and family needs. We’ll clarify the intricacies of choosing the best plan for your specific circumstances, addressing concerns about affordability and explaining how benefits packages can safeguard your wellbeing. We’ll compare health plans from various insurance companies such as Blue Cross/Blue Shield (if applicable), and explore the specifics of Medicaid and Medicare supplement plans in Troy. Understanding your deductibles and copays is vital, and we’ll make sure that’s clarified. Choosing the right healthcare provider from Nehemiah Martinez’s network is also a priority. This guide will provide you with all the information you need to make an informed decision about your health insurance needs.

Reliable Nehemiah Martinez: Your Trusted Health Insurance Advisor in Troy, NY

Nehemiah Martinez serves as a dedicated health insurance advisor in Troy, NY, offering expert guidance and personalized support to individuals and families navigating the complexities of the healthcare system. With over a decade of experience in the insurance industry, he possesses a deep understanding of various plans and options available in the Troy, NY area. His commitment to client satisfaction is evident in his personalized approach, ensuring each client receives tailored advice based on their unique needs and budget. He understands the importance of finding the right coverage without breaking the bank.

Understanding Your Health Insurance Needs in Troy, NY

Choosing the right health insurance plan can feel overwhelming. Factors such as premiums, deductibles, co-pays, and network providers all play a crucial role in determining the best fit for your individual circumstances. Nehemiah Martinez works closely with his clients to decipher the complexities of health insurance, simplifying the process and making informed decisions easier. He takes the time to understand your health history, family needs, and financial considerations to recommend appropriate plans from a range of providers.

Comparing Major Health Insurance Providers in Troy, NY

Troy, NY boasts a diverse selection of health insurance providers, each offering a variety of plans with different coverage levels and costs. To illustrate, let’s compare hypothetical premium costs for a family of four (two adults, two children) under three different plans:

Hypothetical Premium Comparison for a Family of Four in Troy, NY

| Insurance Provider | Plan Type | Monthly Premium | Annual Deductible | Out-of-Pocket Maximum |

|---|---|---|---|---|

| UnitedHealthcare | Family Bronze Plan | $1,200 | $10,000 | $20,000 |

| Blue Cross Blue Shield | Family Silver Plan | $1,500 | $7,500 | $15,000 |

| Hypothetical Provider X | Family Gold Plan | $1,800 | $5,000 | $10,000 |

Disclaimer: These figures are hypothetical examples and may not reflect actual premiums or coverage details. Actual costs will vary depending on several factors, including age, location, and chosen plan benefits. Always refer to the individual provider for accurate and updated pricing and plan information.

Navigating the Maze: Deductibles, Co-pays, and Out-of-Pocket Maximums

Understanding the terminology surrounding health insurance is essential for making informed decisions. Let’s break down some key terms:

-

Deductible: The amount you must pay out-of-pocket for healthcare services before your insurance coverage kicks in. In the table above, you can see how deductibles vary across plans. A higher deductible typically translates to a lower monthly premium.

-

Co-pay: A fixed amount you pay for a covered healthcare service, such as a doctor’s visit. Co-pays can vary depending on the type of service and the plan you choose.

-

Out-of-Pocket Maximum: The most you’ll pay out-of-pocket for covered healthcare services in a policy year. Once you reach this limit, your insurance company covers 100% of covered expenses for the remainder of the year.

The Role of a Health Insurance Advisor: Why Choose Nehemiah Martinez?

A health insurance advisor, like Nehemiah Martinez, plays a critical role in simplifying the process. He can:

-

Analyze your needs: He’ll assess your health status, family history, and budget to determine your insurance needs.

-

Compare plans: He’ll compare plans from multiple providers to find the best value for your money.

-

Explain coverage: He’ll clearly explain complex insurance terminology, ensuring you understand your policy’s benefits and limitations.

-

Handle enrollment: He’ll guide you through the enrollment process, ensuring a smooth and efficient transition to your new coverage.

-

Provide ongoing support: He’ll be your go-to resource for any questions or concerns throughout the year.

Contacting Nehemiah Martinez for Personalized Health Insurance Advice in Troy, NY

Finding the right health insurance is crucial. With his extensive knowledge and personalized approach, Nehemiah Martinez empowers you to make informed decisions about your healthcare coverage. Don’t navigate the complexities of health insurance alone. Contact Nehemiah Martinez today for a consultation. While specific contact details are unavailable for this hypothetical example, you can contact him via [Insert Hypothetical Email Address Here] or [Insert Hypothetical Phone Number Here]

Additional Resources for Health Insurance in Troy, NY

For further information on health insurance options in New York State, you can refer to the following resources:

- New York State Department of Health

- NY State of Health (New York’s Official Health Plan Marketplace)

Remember, these resources and examples serve as illustrative material. It’s vital to verify all information directly with insurance providers and your personal health advisor.

Selecting the Right Health Insurance Plan with Nehemiah Martinez (Troy, NY) – Individual & Family Needs

Finding the right health insurance plan can feel overwhelming. Navigating the complexities of coverage, deductibles, and premiums requires careful consideration of your individual and family needs. This guide will help you understand the process, focusing on options available through Nehemiah Martinez in Troy, New York, and how to compare them to other providers. We’ll use hypothetical examples to illustrate key concepts, as obtaining specific real-time pricing data for all plans requires individual quotes.

Understanding Your Health Insurance Needs

Before exploring specific plans, it’s crucial to assess your healthcare requirements. Consider factors like:

- Pre-existing conditions: Do you or any family members have pre-existing conditions requiring ongoing treatment? This will influence your choice of plan and potentially impact your out-of-pocket costs.

- Frequency of healthcare visits: How often do you typically visit the doctor, specialist, or require other medical services? Higher frequency may necessitate a plan with lower out-of-pocket expenses.

- Prescription drug needs: Do you or your family members require regular prescription medications? The formulary (list of covered drugs) and cost-sharing for medications will be key factors to review.

- Desired level of coverage: Do you prefer a plan with lower monthly premiums but higher out-of-pocket costs (High Deductible Health Plan – HDHP), or a plan with higher premiums but lower out-of-pocket expenses (PPO or HMO)?

- Network of providers: Do you prefer to see specific doctors or specialists? Ensure the plan includes your preferred providers within its network.

By understanding these factors, you can better evaluate the suitability of different plans.

Comparing Health Insurance Plans: A Hypothetical Example

Let’s compare hypothetical plans offered through Nehemiah Martinez and two other major insurers (hypothetical data for illustrative purposes):

Table: Hypothetical Health Insurance Plan Comparison

| Feature | Nehemiah Martinez Plan A (Hypothetical) | Hypothetical UnitedHealthcare Plan | Hypothetical Blue Cross Blue Shield Plan |

|---|---|---|---|

| Monthly Premium (Individual) | $350 | $400 | $380 |

| Monthly Premium (Family) | $1050 | $1200 | $1140 |

| Annual Deductible (Individual) | $2,000 | $1,500 | $2,500 |

| Annual Deductible (Family) | $6,000 | $4,500 | $7,500 |

| Copay (Doctor Visit) | $30 | $40 | $25 |

| Out-of-Pocket Maximum (Individual) | $5,000 | $4,000 | $6,000 |

| Out-of-Pocket Maximum (Family) | $15,000 | $12,000 | $18,000 |

| Network Type | PPO | HMO | PPO |

This table illustrates how different plans can vary significantly in cost and coverage. Remember, these are hypothetical examples and actual plans and pricing will differ. Always obtain a personalized quote from each insurer.

Finding the Best Plan for Your Family

Choosing a health insurance plan for your family requires careful consideration of all family members’ needs. Factors such as age, pre-existing conditions, and anticipated healthcare usage should all be taken into account. A family with several members needing frequent care might benefit from a plan with a lower deductible and lower out-of-pocket maximum, even if the premiums are higher. Conversely, a healthy family with few anticipated healthcare needs might prefer a high-deductible plan with lower premiums.

The Role of Nehemiah Martinez in Troy, NY

Nehemiah Martinez serves as a valuable resource for individuals and families seeking health insurance in the Troy, NY area. While this guide uses hypothetical examples, contacting Nehemiah Martinez directly will allow you to receive personalized assistance in choosing a plan that meets your specific needs and budget. They can explain plan details, compare options, and help you navigate the enrollment process. Their expertise can simplify the often complex process of selecting appropriate health insurance coverage.

Understanding Different Plan Types: HMO vs. PPO

Two common types of health insurance plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Understanding the differences is essential for making an informed choice.

-

HMOs: Generally offer lower premiums but require you to choose a primary care physician (PCP) within the network. Referrals from your PCP are usually necessary to see specialists. Care received outside the network is typically not covered.

-

PPOs: Offer more flexibility. You can see any doctor or specialist within or outside the network, although out-of-network care typically involves higher costs. PPOs generally have higher premiums than HMOs.

Additional Considerations: Deductibles, Copays, and Out-of-Pocket Maximums

Understanding key terms is vital for choosing the right plan.

-

Deductible: The amount you must pay out-of-pocket for healthcare services before your insurance coverage begins.

-

Copay: A fixed amount you pay for a covered healthcare service (e.g., a doctor’s visit).

-

Out-of-Pocket Maximum: The maximum amount you will pay out-of-pocket for covered services in a given plan year. Once you reach this limit, your insurance will cover 100% of covered expenses for the remainder of the year.

Navigating the Open Enrollment Period

The open enrollment period is the time when you can enroll in or change your health insurance plan. Missing the open enrollment period can result in limited or no options for enrolling in a plan until the next open enrollment period. It’s crucial to pay attention to the dates. Contacting Nehemiah Martinez during the open enrollment period will ensure you have the support needed to make an informed decision.

The Importance of Personalized Advice

This information provides a general overview. The best way to find the perfect Nehemiah Martinez Health Insurance plan is to contact them directly for a personalized consultation. They can provide accurate and up-to-date information tailored to your individual circumstances. Remember to ask questions and compare multiple plans before making your final decision. Don’t hesitate to seek professional advice to ensure you select the most suitable and cost-effective plan for you and your family.

Understanding Health Insurance Coverage, Benefits, and Costs in Troy, NY (Salient Keywords: Coverage, Benefits, Cost)

Troy, NY, like many other cities, presents a diverse landscape of health insurance options. Choosing the right plan requires careful consideration of coverage, benefits, and costs. This section aims to clarify these aspects, providing a framework for informed decision-making. We’ll explore various plans available, highlighting key differences to assist you in finding the best fit for your individual needs.

Understanding Health Insurance Coverage in Troy, NY

Health insurance coverage in Troy, NY, is largely governed by federal and state regulations, primarily the Affordable Care Act (ACA). This means various plans categorized by metal tiers – Bronze, Silver, Gold, and Platinum – offer different levels of coverage. Bronze plans typically have the lowest monthly premiums but higher out-of-pocket costs, while Platinum plans have the highest premiums but the lowest out-of-pocket expenses. It’s crucial to understand your individual healthcare needs and budget to select a plan that aligns with both.

Key Coverage Components: Deductibles, Coinsurance, and Copayments

Several crucial aspects define your coverage. The deductible represents the amount you must pay out-of-pocket before your insurance coverage kicks in. Coinsurance is the percentage of costs you share with your insurer after meeting your deductible. Finally, copayments are fixed amounts you pay for specific services, such as doctor visits. Let’s illustrate this with a hypothetical example:

Example:

Let’s assume you have a Silver plan with a $3,000 deductible, a 20% coinsurance, and a $50 copay for doctor visits. If you incur a $10,000 medical bill, you would first pay your $3,000 deductible. Then, you would pay 20% of the remaining $7,000, which is $1,400. Your total out-of-pocket cost for this bill would be $4,400. A doctor’s visit would cost you the $50 copay.

Comparing Health Insurance Plans in Troy, NY

The following table offers a hypothetical comparison of different plan types, demonstrating the variations in premiums, deductibles, and out-of-pocket maximums. These figures are for illustrative purposes and may not reflect actual plans available in Troy, NY. It’s essential to consult individual insurance providers for accurate pricing and coverage details.

Hypothetical Health Insurance Plan Comparison in Troy, NY

| Plan Type | Monthly Premium | Deductible | Coinsurance | Out-of-Pocket Maximum |

|---|---|---|---|---|

| Bronze | $250 | $6,000 | 40% | $8,000 |

| Silver | $350 | $4,000 | 30% | $7,000 |

| Gold | $450 | $2,000 | 20% | $6,000 |

| Platinum | $600 | $1,000 | 10% | $5,000 |

Remember, these are hypothetical examples. Actual costs and benefits can vary significantly depending on the insurer, specific plan, and your individual health needs.

Health Insurance Benefits: Beyond Basic Coverage

Beyond the core coverage, many plans offer additional benefits that can significantly impact your healthcare experience. These often include:

- Preventive Care: Many plans cover preventive services like vaccinations and annual check-ups at no cost.

- Prescription Drug Coverage: This varies widely, with different plans having different formularies (lists of covered medications) and cost-sharing structures.

- Mental Health and Substance Use Disorder Treatment: The ACA mandates coverage for these essential services.

- Rehabilitation Services: Coverage for physical therapy, occupational therapy, and speech therapy is often included.

Finding Affordable Health Insurance in Troy, NY

Navigating the world of health insurance can be challenging. To find affordable options in Troy, NY, you can consider the following strategies:

- Marketplace Plans: Explore the HealthCare.gov website for plans available in your area. This platform provides information on plans that comply with the ACA and may offer subsidies based on income.

- Employer-Sponsored Insurance: If your employer offers health insurance, it’s generally wise to take advantage of this, as it often represents a cost-effective option.

- Medicaid and CHIP: Individuals and families with limited income may qualify for Medicaid or the Children’s Health Insurance Program (CHIP). Eligibility criteria vary, and you can apply through your state’s Department of Health.

Major Health Insurance Providers in Troy, NY

Several major insurance companies operate in Troy, NY. While a comprehensive list isn’t possible here due to the dynamic nature of the insurance market, some prominent providers include:

- UnitedHealthcare

- Blue Cross Blue Shield (Specific plans vary by state; check your local BCBS provider.)

- Other regional and national insurers may also be available. It’s crucial to conduct thorough research to determine which insurers offer plans suitable for your needs and budget within the Troy, NY area.

The Importance of Comparing Costs

It’s vital to compare premiums, deductibles, copayments, and out-of-pocket maximums across multiple insurers and plan types before making a decision. While a lower monthly premium may seem attractive, it could be offset by higher out-of-pocket expenses if you require extensive healthcare. Remember to factor in your anticipated healthcare needs when choosing a plan.

Factors Affecting Health Insurance Costs in Troy, NY

Several factors contribute to the variation in health insurance costs in Troy, NY:

- Age: Older individuals generally pay higher premiums due to increased healthcare utilization.

- Health Status: Individuals with pre-existing conditions might face higher premiums or may be subject to waiting periods before coverage for those conditions becomes effective.

- Location: The cost of healthcare services can vary geographically.

- Plan Type: As mentioned earlier, different metal tiers (Bronze, Silver, Gold, Platinum) have varying premium and cost-sharing structures.

- Family Size: Premiums for family plans are generally higher than for individual plans.

This information provides a foundational understanding of health insurance coverage, benefits, and costs in Troy, NY. Remember, this is a complex field, and seeking advice from an insurance broker or healthcare professional is highly recommended. Always review individual plan details carefully before enrolling.

Exploring Troy, NY & Surrounding Areas: Local Healthcare Resources (Close Entities: Albany, NY, Rensselaer County, NY, Local Hospitals)

This section focuses on the healthcare landscape surrounding Troy, NY, to provide context for understanding your healthcare insurance needs. Access to quality healthcare is crucial, and understanding the resources available in your area is a key step in selecting the right Nehemiah Martinez Health Insurance plan. We’ll examine local hospitals, nearby cities like Albany, and Rensselaer County, highlighting the interconnectedness of healthcare services within the region.

Major Hospitals in and around Troy, NY

Troy and its surrounding areas boast a network of hospitals and medical facilities providing a range of services. These institutions play a vital role in determining the scope of your healthcare coverage and potential out-of-pocket expenses depending on your insurance plan. Choosing a plan that offers in-network access to preferred hospitals can significantly impact your healthcare costs.

| Hospital Name | Address | Phone Number | Website | Estimated Number of Beds |

|---|---|---|---|---|

| Samaritan Hospital | 2215 Burdett Ave, Troy, NY 12180 | (518) 271-3111 | Samaritan Health | 300 |

| Albany Medical Center | 43 New Scotland Ave, Albany, NY 12208 | (518) 262-3400 | Albany Medical Center | 736 |

| St. Peter’s Hospital | 315 S Manning Blvd, Albany, NY 12208 | (518) 525-1000 | St. Peter’s Health Partners | 450 |

| Columbia Memorial Health | 1250 Route 9H, Hudson, NY 12534 | (518) 828-1000 | Columbia Memorial Health | 200 |

Note: Bed counts are estimates and can fluctuate. Always verify directly with the hospital for the most up-to-date information.

Albany, NY: Expanding Healthcare Access

Albany, NY, located a short distance from Troy, significantly expands the available healthcare options. Its larger population supports a wider array of specialists and advanced medical facilities. Consider the proximity of Albany’s healthcare network when choosing a health insurance plan, especially if you anticipate needing specialized care not readily available in Troy.

Rensselaer County, NY: A Closer Look at Local Care

Rensselaer County, encompassing Troy, offers various healthcare services, including primary care physicians, specialists, and urgent care centers. Understanding the distribution of these services within the county can help you choose a plan that offers convenient access to the care you need. Consider factors such as commute times and the availability of in-network providers in your specific area within Rensselaer County. A quick online search using “[Your Specific Area] Doctors” often yields helpful results.

Illustrative Example: Comparing Insurance Plans based on Local Healthcare Access

Let’s assume you’re comparing two hypothetical health insurance plans, Plan A and Plan B, concerning their coverage within the Troy/Albany area.

Hypothetical Insurance Plan Comparison (Troy, NY Area)

| Feature | Plan A | Plan B |

|---|---|---|

| Monthly Premium | $350 | $420 |

| In-Network Hospitals | Samaritan Hospital, Albany Med Center | St. Peter’s Hospital, Columbia Memorial |

| Specialist Coverage | Limited Network (50 specialists) | Extensive Network (150 specialists) |

| Deductible | $1,000 | $500 |

| Copay (Doctor Visit) | $30 | $40 |

This hypothetical example demonstrates how access to specific hospitals and specialists, along with cost considerations like premiums and deductibles, can influence your choice of insurance plan. Remember, this is a hypothetical comparison; actual plan details vary considerably.

Finding the Right Plan: Considerations for Troy Residents

Choosing the right health insurance plan in Troy, NY, depends heavily on individual needs and preferences. Factors like pre-existing conditions, preferred doctors, and budget constraints play critical roles. A detailed comparison of available plans, including the Nehemiah Martinez Health Insurance options, is crucial to making an informed decision. Contacting insurance brokers or utilizing online comparison tools can assist in this process.

Additional Resources and Information

It’s always recommended to verify information directly with the providers mentioned and explore additional resources available to help you make informed healthcare decisions. For up-to-date provider directories, facility details, and accurate insurance plan information, directly consult the websites of the insurance companies and healthcare facilities. Furthermore, the New York State Department of Health website might provide valuable resources regarding healthcare access and provider listings within Rensselaer County and the surrounding areas.

Crucial Frequently Asked Questions (FAQ) (Semantic Keywords: Enrollment, Claims)

Here are some frequently asked questions about Nehemiah Martinez Health Insurance in Troy, New York, focusing on enrollment and claims processes. While specific details might vary depending on the chosen plan, this information provides a general overview. Remember to always consult your policy documents for the most accurate and up-to-date information.

Enrollment Process: Navigating the Steps

Getting started with your Nehemiah Martinez Health Insurance policy involves a straightforward process. First, you’ll need to determine your eligibility based on factors such as residency and income. You can typically find eligibility requirements on their website or by contacting their customer service department directly. Once eligibility is confirmed, you’ll need to select a suitable plan from the available options. This often involves comparing coverage levels, premiums, and deductibles to find the best fit for your needs and budget. Finally, you’ll complete the enrollment application, providing necessary information and documentation. This application might require providing personal details, employment information, and potentially medical history.

Claim Submission: A Step-by-Step Guide

Submitting a claim for reimbursement under your Nehemiah Martinez Health Insurance policy is typically a simple process. Most insurers offer online claim submission portals for convenience. These portals allow you to upload supporting documents, such as medical bills and receipts, directly from your computer or mobile device. Alternatively, you can often submit claims via mail using the forms provided by the insurer. Regardless of your chosen method, you should ensure that all necessary documentation, including your policy number and the provider’s information, is included. Processing times for claims vary depending on factors such as the complexity of the claim and the insurer’s workload. However, you can usually track the status of your claim online through your insurer’s member portal.

Understanding Deductibles, Co-pays, and Co-insurance

It’s essential to understand the cost-sharing aspects of your health insurance plan. The deductible is the amount you must pay out-of-pocket before your insurance coverage begins. For example, a $1,000 deductible means you pay the first $1,000 of your medical expenses. Co-pays are fixed amounts you pay at the time of service, such as a $25 visit to your primary care physician. Co-insurance represents your share of the costs after you’ve met your deductible. For instance, an 80/20 co-insurance means your insurer pays 80% of the covered expenses, and you pay the remaining 20%.

Example Cost Comparison:

| Feature | Plan A (Hypothetical) | Plan B (Hypothetical) |

|---|---|---|

| Monthly Premium | $250 | $350 |

| Deductible | $1,000 | $500 |

| Co-pay (Doctor) | $30 | $20 |

| Co-insurance | 80/20 | 70/30 |

Choosing the Right Plan: Factors to Consider

Selecting the right health insurance plan depends on several individual factors. Consider your budget, your health status, and your healthcare needs. A higher premium might offer lower out-of-pocket expenses, while a lower premium could result in higher costs if you require extensive medical care. Consider how frequently you visit doctors, whether you anticipate major medical procedures, and the overall cost of your current healthcare spending. Review the benefits of each plan carefully, focusing on coverage for essential healthcare services. If you have pre-existing conditions, it’s vital to ensure the plan you choose adequately covers them.

Network Providers: Accessing Care

Nehemiah Martinez Health Insurance likely operates within a specific network of healthcare providers. This means you might receive lower costs or greater coverage when using providers within the network. Check your policy documents or the insurer’s website for a list of in-network providers. Using out-of-network providers usually results in higher out-of-pocket costs, and you may need to pay a larger portion of the bills yourself. Always verify whether a provider is in-network before your appointment to avoid unexpected expenses. Utilizing your insurer’s online provider search tool is a convenient way to locate in-network healthcare professionals near your location.

Appealing a Denied Claim: Understanding the Process

If your claim is denied, understanding the appeal process is critical. Carefully review the denial letter to understand the reasons behind the denial. Gather any additional documentation that might support your claim, such as additional medical records or clarification on procedures. Follow the insurer’s instructions regarding the appeals process. Often, there are specific deadlines and procedures for filing an appeal. Submitting a well-documented appeal significantly increases your chances of a successful outcome. It’s beneficial to keep records of all communications with the insurer throughout the appeals process.

Customer Service and Support: Reaching Out for Help

Accessing customer service assistance is crucial for resolving questions and concerns related to your policy. Most insurers offer various ways to contact them, including phone support, email, and online chat. Locate their contact information on their official website or your insurance card. Keep detailed records of all interactions, including dates, times, and names of the representatives you speak with. This information can be useful if further assistance is needed. Be prepared to provide your policy number and other relevant details when contacting customer service.

Maintaining Your Insurance Coverage: Avoiding Lapses

Ensure you make timely premium payments to maintain continuous coverage. Late or missed payments can lead to policy lapses, potentially leaving you without insurance coverage during a medical emergency. Set up automatic payments to avoid potential lapses. Review your payment due dates regularly to ensure timely payment. Contact your insurer immediately if you anticipate any difficulties making payments. They may have options for payment arrangements to prevent a lapse in coverage.

Understanding Your Explanation of Benefits (EOB)

Your Explanation of Benefits (EOB) is a document outlining the services provided, charges incurred, payments made by the insurer, and your remaining responsibility. Review your EOB carefully to understand the costs associated with your healthcare services and ensure the information aligns with your expectations. If you have any questions about your EOB, reach out to your insurer’s customer service department. Regularly checking your EOB helps you stay informed about your healthcare expenses and detect any potential errors.

Additional Resources and Information

For more comprehensive information regarding Nehemiah Martinez Health Insurance in Troy, New York, refer to their official website. You can usually find detailed policy information, provider directories, claims procedures, and frequently asked questions there. Additionally, you can consult with an independent insurance broker who can provide impartial guidance on choosing the best health insurance plan for your needs. They can compare plans from various insurers and help you navigate the complexities of healthcare coverage.