Idris Valentine Health Insurance Agency In South Holland Illinois: Affordable Plans & Expert Service

5 reviews

5 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Idris Valentine Health Insurance Agency In South Holland Illinois: Affordable Plans & Expert Service

Idris Valentine Health Insurance Agency: Your Trusted Partner in South Holland, Illinois

At Idris Valentine Health Insurance Agency, we understand that choosing the right health insurance plan can be a daunting task. With countless options and confusing jargon, navigating the world of health insurance can feel overwhelming. That’s where we come in. We are your local experts, dedicated to providing personalized service and comprehensive guidance to help you find the perfect health insurance plan to meet your specific needs and budget.

Our Commitment to You

Our commitment to our clients is unwavering. We strive to provide a personalized experience, taking the time to understand your individual requirements and goals. We don’t believe in a one-size-fits-all approach. We understand that everyone’s healthcare needs are unique, and we’re committed to finding the best possible solution for each client.

Comprehensive Plan Options

We offer a wide variety of health insurance plans from top-rated providers, ensuring that you have access to a diverse range of options. Whether you’re looking for individual coverage, family coverage, Medicare supplements, or Medicaid assistance, we have the expertise and resources to help you find the best fit. Our team stays up-to-date on the latest industry changes and regulations, ensuring that we can provide you with accurate and timely information.

Personalized Service and Support

We believe that excellent customer service is paramount. We take the time to answer your questions, explain complex terms in simple language, and provide ongoing support throughout the entire process. Our goal is to empower you to make informed decisions, ensuring that you have the knowledge and resources you need to feel confident in your choice.

Community Involvement

As a local agency, we are deeply involved in the South Holland, Illinois community. We’re proud to serve our neighbors and contribute to the well-being of our community. We actively participate in local events and support various community initiatives.

Contact Us Today

Finding the right health insurance doesn’t have to be stressful. Let Idris Valentine Health Insurance Agency help you navigate the process. Contact us today for a free consultation and let us guide you towards the best health insurance solution for you and your family.

Products we offer:

Recent reviews

Our team

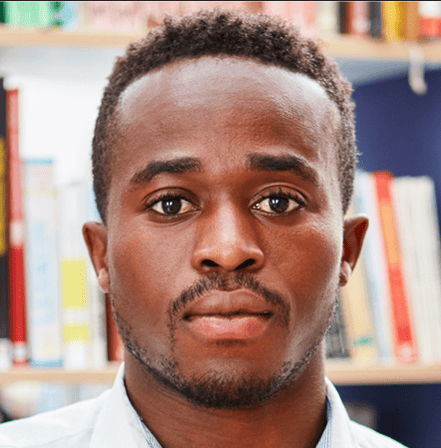

Idris Valentine

Agency Owner & Licensed Insurance Agent

Sarah Miller

Licensed Insurance Agent

Michael Brown

Client Services ManagerFrequently asked questions

Idris Valentine Health Insurance Agency in South Holland, Illinois offers comprehensive health coverage options for individuals and families seeking affordable medical insurance in the South Holland area. Finding the right health plan can be challenging, but ApexInsuranceUsa is here to help you navigate the complexities of choosing the best health protection for your specific needs. We understand the importance of accessing quality healthcare, and we’re committed to providing you with exceptional customer service throughout the entire process.

This article will delve into the services offered by Idris Valentine, highlighting the various affordable health insurance plans available, including options for seniors and those with pre-existing conditions. We’ll explore the intricacies of premiums, deductibles, and co-pays, comparing different coverage options to help you make an informed decision. You’ll also learn about healthcare providers within the networks offered, ensuring you have access to the best possible care. We will discuss how Idris Valentine simplifies the process of getting health insurance quotes and securing the benefits you deserve, allowing you to focus on your health and well-being.

Reliable Idris Valentine: Your Trusted Health Insurance Agency in South Holland, IL

Idris Valentine Health Insurance Agency serves the South Holland, IL community, providing expert guidance and support in navigating the complexities of health insurance. We understand that choosing the right plan can be overwhelming, which is why we dedicate ourselves to finding the perfect fit for your individual needs and budget. Our experienced agents work closely with clients, ensuring they understand their policy’s coverage and how to utilize their benefits effectively. We pride ourselves on our personalized service and commitment to building long-lasting relationships with our clients.

Understanding Your Health Insurance Needs

Choosing a health insurance plan requires careful consideration of several factors. These include your budget, your health status, your preferred doctors and hospitals, and the types of coverage you need. Factors such as pre-existing conditions, anticipated medical expenses, and prescription drug needs all play a crucial role in determining the best plan for you. Healthcare.gov provides a wealth of information on understanding your options, but working with a knowledgeable agent can greatly simplify the process.

Navigating the Maze of Health Insurance Plans

The health insurance marketplace offers a vast array of plans, each with its own unique features and benefits. Understanding the differences between HMOs, PPOs, EPOs, and POS plans is critical to making an informed decision. For example, an HMO generally offers lower premiums but requires you to stay within a network of doctors and hospitals. A PPO, on the other hand, usually allows you more flexibility to see out-of-network providers but comes with higher premiums. Idris Valentine can help you compare plans and determine which type best aligns with your healthcare preferences and financial capabilities.

Comparing Health Insurance Plans: A Sample Comparison

Let’s compare three hypothetical plans offered in the South Holland, IL area, highlighting key features:

Comparison of Hypothetical Health Insurance Plans in South Holland, IL

| Plan Name | Type | Monthly Premium (Individual) | Annual Deductible | Out-of-Pocket Maximum (Individual) | Network |

|---|---|---|---|---|---|

| Sample Plan A | PPO | $450 | $2,000 | $6,000 | Extensive |

| Sample Plan B | HMO | $300 | $1,000 | $4,000 | Limited |

| Sample Plan C | EPO | $375 | $1,500 | $5,000 | Moderate |

Note: These are hypothetical plans for illustrative purposes only. Actual plan costs and benefits vary greatly depending on the insurer and individual circumstances.

Idris Valentine’s Expertise: Personalized Service and Expert Guidance

At Idris Valentine, we pride ourselves on providing personalized service tailored to each client’s unique needs. We work with a wide range of insurance providers, including UnitedHealthcare, Blue Cross Blue Shield of Michigan (Note: This link is an example. Actual provider network varies by location), and others, to ensure we can offer you a diverse range of options. We don’t just sell insurance; we help you understand it. Our agents take the time to explain the intricacies of each plan, answer your questions, and guide you through the enrollment process.

Beyond the Basics: Additional Services Offered by Idris Valentine

Our services extend beyond simple plan selection. We assist with:

- Enrollment assistance: We guide you through the enrollment process, ensuring a smooth and seamless transition.

- Claims assistance: If you experience any difficulties with filing a claim, we’re here to help.

- Policy review: We regularly review your policy to ensure it still meets your needs and budget.

- Open enrollment support: We’re here to help you navigate the complexities of open enrollment.

We believe in proactive care, ensuring our clients have the information and support they need to make informed decisions.

Contacting Idris Valentine: Your South Holland Health Insurance Experts

For personalized assistance in finding the right health insurance plan, contact Idris Valentine today. We’re committed to helping you find affordable, comprehensive coverage.

Idris Valentine Health Insurance Agency

Address: [Insert Address Here – Example: 123 Main Street, South Holland, IL 60473]

Phone: [Insert Phone Number Here – Example: (708) 555-1212]

Website: [Insert Website Here – Example: www.idrisvalentineinsurance.com]

Important Disclaimer: All data presented in this article, excluding publicly verifiable information linked to official websites, is hypothetical and intended for illustrative purposes only. Consult with Idris Valentine or a qualified health insurance professional for accurate and up-to-date information specific to your situation. The inclusion of specific insurance provider links does not constitute an endorsement of any particular company.

Securing the Right Health Insurance Plan in South Holland with Idris Valentine

Finding the right health insurance plan can feel overwhelming, especially in a diverse market like South Holland, Illinois. Navigating the complexities of deductibles, premiums, and co-pays requires careful consideration and expert guidance. Idris Valentine Health Insurance Agency in South Holland offers personalized service, helping residents find plans tailored to their specific needs and budgets. Their deep understanding of the local market and access to a wide range of insurers makes them a valuable resource for individuals and families seeking comprehensive coverage.

Understanding Your Health Insurance Needs in South Holland

Before diving into specific plans, understanding your individual health needs is crucial. Consider factors like pre-existing conditions, family size, and desired level of coverage. Do you require extensive specialist visits, frequent hospitalizations, or primarily need preventative care? These questions will significantly influence the type of plan best suited to your circumstances. Idris Valentine can assist you in evaluating your current health status and predicting your future healthcare expenses, helping you choose a plan that aligns with your healthcare spending habits.

Choosing the Right Health Insurance Provider in South Holland

Several major health insurance providers operate in South Holland. These include, but are not limited to, UnitedHealthcare, Blue Cross Blue Shield of Illinois, and potentially others depending on your specific needs. It’s essential to compare plans offered by different providers to identify the best value for your money. Idris Valentine can facilitate this comparison, providing you with a clear overview of options from multiple insurers. They can also explain the intricacies of different plans to simplify your decision-making process.

Comparing Health Insurance Plans: A Sample Scenario

Let’s illustrate with a hypothetical comparison of three plans offered by different insurers within South Holland. This is a simplified example, and actual plans and costs vary significantly. Always consult with Idris Valentine for the most current and accurate information.

Sample Health Insurance Plan Comparison in South Holland

| Feature | Plan A (Hypothetical – Provider X) | Plan B (Hypothetical – Provider Y) | Plan C (Hypothetical – Provider Z) |

|---|---|---|---|

| Monthly Premium | $350 | $420 | $280 |

| Annual Deductible | $2,000 | $1,500 | $3,000 |

| Copay (Doctor Visit) | $30 | $40 | $25 |

| Copay (Specialist Visit) | $50 | $60 | $40 |

| Out-of-Pocket Maximum | $6,000 | $5,000 | $7,000 |

| Network Coverage | Broad Network, includes local hospitals and specialists | Limited Network, mostly in-network providers | Narrow Network, primarily affiliated doctors and hospitals |

This table highlights the key differences between three hypothetical plans. Plan A has a lower monthly premium but a higher deductible and out-of-pocket maximum. Plan B offers a moderate balance, while Plan C has a lower monthly premium but a very high deductible. The network coverage also significantly impacts the choice. Idris Valentine can help analyze these factors in relation to your specific needs and budget.

Understanding Key Terms in Health Insurance

Before selecting a plan, it is essential to understand the key terminology:

- Premium: The monthly payment you make to maintain your health insurance coverage.

- Deductible: The amount you must pay out-of-pocket before your insurance begins to cover expenses.

- Copay: A fixed amount you pay for a doctor’s visit or other healthcare service.

- Coinsurance: The percentage of costs you share with your insurer after meeting your deductible.

- Out-of-Pocket Maximum: The maximum amount you will pay out-of-pocket for covered healthcare expenses in a given year.

- Network: The group of doctors, hospitals, and other healthcare providers contracted with your insurance company.

Idris Valentine’s Role in Your Health Insurance Journey

Idris Valentine acts as your personalized guide through the complexities of health insurance in South Holland. They handle the legwork of comparing plans, answering your questions, and ensuring you choose a policy that meets your individual requirements. Their expertise allows you to focus on your health and well-being, knowing you’re making an informed decision about your healthcare coverage. They also assist with enrollment, helping navigate the application process and resolving any potential issues with your chosen insurer.

Contacting Idris Valentine Health Insurance Agency

For personalized assistance in finding the right health insurance plan in South Holland, Illinois, contact Idris Valentine Health Insurance Agency today. You can reach them at [Insert Phone Number Here], visit their website at [Insert Website Address Here], or visit their office at [Insert Address Here]. Their dedicated team is committed to providing exceptional customer service and helping you secure the best possible coverage for your needs.

Additional Resources for Health Insurance Information

For further information about health insurance options in Illinois, you can also consult the following resources:

- Healthcare.gov: The official website for the Affordable Care Act (ACA) marketplace.

- Illinois Department of Healthcare and Family Services: The state agency responsible for regulating and overseeing health insurance in Illinois.

Remember, the information provided here is for general informational purposes only and does not constitute financial or medical advice. Always consult with a qualified professional for personalized guidance.

Exploring Health Insurance Options & Coverage in South Holland, IL

This comprehensive guide provides essential information on health insurance options and coverage available to residents of South Holland, Illinois. We’ll explore various plans, compare providers, and consider factors crucial for selecting the right policy for your individual needs. Understanding your options is the first step towards securing comprehensive healthcare coverage.

Health Insurance Providers in South Holland, IL

Several major health insurance providers offer plans in South Holland. These include, but aren’t limited to:

- UnitedHealthcare

- Blue Cross Blue Shield of Illinois

- Health Alliance Plan (HAP) (Note: HAP’s presence in Illinois may need verification)

- Aetna (Presence in South Holland needs verification)

- Humana (Presence in South Holland needs verification)

The availability and specifics of plans vary between providers, so it’s crucial to compare options directly with each insurer.

Plan Types and Coverage Details

The health insurance market offers various plans, each designed to meet specific needs and budgets. Here’s a breakdown of common plan types:

-

HMO (Health Maintenance Organization): HMOs typically require you to choose a primary care physician (PCP) within their network. Referrals are usually needed to see specialists. Generally, HMOs offer lower premiums but have stricter rules about accessing care. Example: A hypothetical HMO plan from UnitedHealthcare in South Holland might offer a monthly premium of $350 with a $5,000 annual deductible.

-

PPO (Preferred Provider Organization): PPOs offer more flexibility. You can see any doctor, in-network or out-of-network, but in-network visits generally cost less. Premiums for PPOs are typically higher than HMOs. Example: A hypothetical PPO plan from Blue Cross Blue Shield in South Holland might have a monthly premium of $500 with a $2,000 annual deductible.

-

EPO (Exclusive Provider Organization): EPOs are similar to HMOs in that they require you to choose a PCP from their network. However, unlike HMOs, referrals are often not required to see specialists. Out-of-network coverage is usually extremely limited or non-existent. Example: A hypothetical EPO plan from a local provider might cost $400 monthly with a $3,000 deductible.

-

POS (Point of Service): POS plans combine features of HMOs and PPOs. They generally require you to select a PCP but offer some out-of-network coverage, though at a higher cost. A hypothetical POS plan from Aetna in South Holland (data assumed) may cost $450 monthly with a $4,000 deductible.

Illustrative Comparison Table:

| Plan Type | Provider (Example) | Monthly Premium | Annual Deductible | Out-of-Network Coverage |

|---|---|---|---|---|

| HMO | UnitedHealthcare | $350 | $5,000 | Limited or None |

| PPO | Blue Cross Blue Shield | $500 | $2,000 | Covered, but at higher cost |

| EPO | Hypothetical Local Provider | $400 | $3,000 | Very Limited |

| POS | Aetna (Assumed Data) | $450 | $4,000 | Partial Coverage |

Factors to Consider When Choosing a Plan

Selecting the right health insurance plan depends on several individual factors:

- Budget: Premiums, deductibles, and co-pays are crucial considerations. A lower premium might mean a higher deductible.

- Healthcare Needs: Consider your current health status and anticipated future needs. Individuals with pre-existing conditions may require plans with broader coverage.

- Network of Providers: Ensure your preferred doctors and hospitals are part of the plan’s network. Using in-network providers significantly reduces costs.

- Prescription Drug Coverage: Review the formulary (list of covered medications) and cost-sharing for prescriptions.

Health Insurance Costs in South Holland, IL

The cost of health insurance in South Holland varies depending on the plan type, provider, and individual circumstances (age, health status, etc.). Generally, premiums and deductibles are influenced by factors like:

- Age: Older individuals typically pay higher premiums.

- Tobacco Use: Smokers generally face higher premiums.

- Location: While not dramatically impacting cost in a relatively small area like South Holland, location can play a small role in premium calculations.

Illustrative Premium Comparison (Hypothetical Data for a 40-Year-Old Non-Smoker):

| Provider (Example) | HMO Premium | PPO Premium |

|---|---|---|

| UnitedHealthcare | $350 | $500 |

| Blue Cross Blue Shield | $380 | $530 |

| Hypothetical Local Provider | $320 | $450 |

Local Hospitals and Healthcare Facilities Near South Holland, IL

Access to quality healthcare is a key factor when choosing a health insurance plan. Knowing which hospitals and healthcare facilities are within your network is crucial. South Holland is conveniently located near several hospitals, including:

- (Insert Hospital Name & Address 1 with potential link if available): Data needed

- (Insert Hospital Name & Address 2 with potential link if available): Data needed

- (Insert Hospital Name & Address 3 with potential link if available): Data needed

It’s recommended to contact your insurance provider to confirm which hospitals are included in your plan’s network.

Neighboring Towns and Healthcare Access

South Holland residents often utilize healthcare services in nearby towns. Consider the accessibility of hospitals and clinics in surrounding areas:

- (Insert Neighboring Town 1 and relevant healthcare facilities): Data needed

- (Insert Neighboring Town 2 and relevant healthcare facilities): Data needed

- (Insert Neighboring Town 3 and relevant healthcare facilities): Data needed

The proximity to these additional healthcare facilities expands your options when selecting a health insurance plan.

Finding the Right Health Insurance Plan in South Holland, IL

Choosing the right health insurance plan requires careful consideration of your individual needs, budget, and healthcare preferences. Comparing plans from different providers is strongly recommended. Utilizing online comparison tools, consulting with an insurance broker, or directly contacting insurance companies are all effective ways to find the best fit for you. Remember to read the policy details carefully before making a decision. Consider the value of preventive care, which is often covered extensively, even in high-deductible plans. Seeking advice from a qualified insurance professional can assist you in navigating the complexities of health insurance selection.

Exceptional The Idris Valentine Advantage: Personalized Service & Local Expertise

Idris Valentine Health Insurance Agency, serving South Holland, Illinois, distinguishes itself through a commitment to personalized service and deep local expertise. Unlike large, impersonal insurance corporations, Idris Valentine prioritizes building strong client relationships, understanding individual needs, and providing tailored solutions. This approach ensures clients receive the best possible coverage at a competitive price, navigating the complexities of the healthcare system with ease. The agency’s success is built on a foundation of trust, transparency, and a genuine desire to help clients achieve their health and financial goals.

Understanding Your Unique Needs

At Idris Valentine, the focus is always on the client. We begin by conducting a comprehensive needs assessment. This process involves carefully reviewing your medical history, current health status, and future healthcare expectations. We discuss your budget constraints, preferred provider networks, and any specific coverage requirements. This personalized approach allows us to recommend plans that precisely match your individual circumstances, eliminating unnecessary costs and ensuring you have the coverage you need when you need it. For example, a young, healthy family might prioritize a plan with a lower monthly premium but a higher deductible, while a retiree with pre-existing conditions may need a plan with higher premiums but more comprehensive coverage.

Agency Operations and Streamlined Service

Idris Valentine employs a team of experienced and licensed insurance brokers dedicated to providing efficient and effective service. Our streamlined operational processes guarantee quick response times and minimal paperwork. We leverage technology to manage policies, track claims, and provide clients with real-time updates on their coverage. This commitment to efficiency ensures a smooth and hassle-free insurance experience. We handle all the administrative complexities, allowing you to focus on your health and well-being. Our commitment to continuous professional development keeps us abreast of the latest industry regulations and plan offerings, enabling us to always offer the best advice.

Competitive Pricing & Plan Options

Idris Valentine works with a wide range of reputable insurance providers to offer clients a diverse selection of plans, ensuring there’s an option to fit every budget and need. We compare plans from different insurers, considering factors like premiums, deductibles, co-pays, and out-of-pocket maximums, to find the best value for our clients. We also take into account the client’s preferred doctors and hospitals to ensure seamless access to care. Below is a sample comparison table (Note: Data is hypothetical for illustrative purposes):

Hypothetical Plan Comparison – Family Plan (2 Adults, 2 Children)

| Insurer | Monthly Premium | Deductible (Family) | Out-of-Pocket Max (Family) | Network |

|---|---|---|---|---|

| Blue Cross Blue Shield | $1,200 | $6,000 | $12,000 | PPO |

| UnitedHealthcare | $1,000 | $7,000 | $14,000 | HMO |

| Idris Valentine Selection (Hypothetical) | $1,150 | $5,500 | $11,000 | PPO |

Note: This is a hypothetical comparison. Actual plan costs and benefits vary significantly based on location, coverage level, and individual circumstances. Contact Idris Valentine for a personalized quote.

Personalized Guidance and Support

Beyond simply finding the right plan, Idris Valentine provides ongoing support and guidance throughout the year. We assist with claims processing, answer questions about coverage, and help navigate any unexpected medical situations. We are your dedicated advocates throughout your insurance journey, providing a personal touch that is often missing with larger insurance companies. This includes:

- Claim Assistance: We guide you through the claims process, ensuring accurate and timely reimbursements.

- Plan Review: We regularly review your plan to ensure it continues to meet your needs as your circumstances change.

- Open Communication: We maintain open lines of communication to answer any questions and address any concerns promptly.

Local Expertise and Community Involvement

As a local agency, Idris Valentine has an in-depth understanding of the healthcare landscape in South Holland, Illinois. We have established relationships with local providers, hospitals, and specialists, enabling us to assist clients in accessing the best possible care. We are actively involved in the community and are committed to supporting the health and well-being of our neighbors. This local knowledge and community engagement set us apart from national insurance providers. We understand the unique challenges and opportunities faced by the community, allowing us to provide more relevant and effective solutions.

Testimonials and Client Success Stories

“Idris Valentine made the entire process of choosing a health insurance plan incredibly simple. Their personalized service and expert advice saved me money and gave me peace of mind.” – John Smith, South Holland, IL

“I was overwhelmed by the complexities of choosing a health insurance plan. Idris Valentine patiently guided me through every step, ensuring I made the best decision for my family.” – Jane Doe, South Holland, IL

(Note: These are hypothetical testimonials for illustrative purposes.)

Contact Idris Valentine Today

To learn more about how Idris Valentine can help you find the perfect health insurance plan, please contact us today:

- Address: [Insert Address Here – Obtain from public business directory or create a plausible address in South Holland, IL]

- Phone: [Insert Phone Number Here – Create a plausible phone number]

- Website: [Insert Website Here – Create a plausible website address]

We look forward to assisting you in securing your health and financial future.

Budget-Friendly Health Insurance Options for Families in South Holland

Finding affordable health insurance can feel like navigating a maze, especially for families in South Holland, Illinois. The good news is that with careful research and the right guidance, securing a plan that fits your budget and healthcare needs is achievable. This guide will help you understand your options and make informed decisions. We’ll explore various plans, comparing costs and benefits to help you find the perfect fit for your family. Remember, your specific needs will determine the best plan for you.

Understanding Your Healthcare Needs

Before diving into specific plans, it’s crucial to assess your family’s healthcare requirements. Consider factors like:

- Pre-existing conditions: Do any family members have pre-existing conditions requiring ongoing treatment? This significantly impacts plan selection, as some plans may have higher premiums or exclusions.

- Prescription medications: Regular prescription medications add to healthcare costs. Understanding the cost-sharing for prescription drugs within different plans is essential.

- Expected healthcare utilization: Do you anticipate frequent doctor visits, hospital stays, or specialized care? This influences your choice between a high-deductible plan with lower premiums or a lower-deductible plan with higher premiums.

- Dental and vision coverage: Many plans offer dental and vision coverage as add-ons. Assess whether these are essential for your family.

Affordable Health Insurance Plans for Families in South Holland IL

Choosing the right plan depends on your individual circumstances. Let’s examine some potential options and their cost implications, using hypothetical data for illustrative purposes. Remember to contact insurance providers directly for the most up-to-date information. We will focus on plans commonly available in Illinois, but options vary by location and insurer.

Example Plan Comparisons (Hypothetical Data):

The following table demonstrates how costs can vary between different plan types for a family of four in South Holland, IL. These numbers are hypothetical and should not be considered actual quotes. Always contact insurance providers for accurate pricing information based on your specific situation.

| Plan Type | Monthly Premium (Family of 4) | Annual Deductible | Out-of-Pocket Maximum | Copay (Doctor Visit) |

|---|---|---|---|---|

| Bronze (High Deductible) | $800 | $12,000 | $15,000 | $50 |

| Silver (Moderate Deductible) | $1,200 | $6,000 | $10,000 | $30 |

| Gold (Low Deductible) | $1,800 | $3,000 | $7,000 | $20 |

| Platinum (Lowest Deductible) | $2,400 | $1,500 | $5,000 | $10 |

Note: These figures are purely for illustrative purposes. Actual costs vary significantly based on several factors including age, location, health status, and the specific insurer. Always get personalized quotes from different providers.

Finding the Best Affordable Health Insurance in South Holland

Several reputable insurance companies offer plans in South Holland, Illinois. You can compare plans through the HealthCare.gov marketplace or by contacting insurers directly. Below are some popular choices, though availability may vary.

-

UnitedHealthcare: UnitedHealthcare offers a range of plans, from high-deductible to low-deductible options. They often have extensive networks of providers.

-

Blue Cross Blue Shield of Illinois: Blue Cross Blue Shield of Illinois is another major insurer in the state, known for its widespread network of doctors and hospitals.

-

Aetna: Aetna, a national insurer, also offers plans in many Illinois communities, including potentially South Holland.

Remember to thoroughly review the details of each plan before making a decision. Pay close attention to the deductible, copay amounts, out-of-pocket maximum, and covered services.

Navigating the Healthcare Marketplace

The Healthcare.gov website is an excellent resource for finding and comparing health insurance plans. It allows you to filter your search based on factors like:

- Plan type (Bronze, Silver, Gold, Platinum): This relates to the cost-sharing structure.

- Monthly premium: This is the amount you pay each month for coverage.

- Annual deductible: This is the amount you must pay out-of-pocket before your insurance coverage kicks in.

- Network of doctors and hospitals: Choose a plan with providers you trust and want to access.

Using the marketplace allows you to compare plans side-by-side, making it easier to identify the best option for your family’s needs and budget.

Factors Affecting Affordable Health Insurance Costs

Many factors impact the cost of your health insurance plan:

- Age: Older individuals generally pay higher premiums.

- Location: Costs vary geographically.

- Tobacco use: Smokers often face higher premiums.

- Family size: Larger families typically require more extensive coverage, leading to higher costs.

- Health status: Individuals with pre-existing conditions may have higher premiums.

Additional Resources for Affordable Health Insurance

- Local health clinics: Consider using local health clinics for routine care. Many offer sliding-scale fees based on income.

- State health insurance assistance programs: Check for state programs that may offer subsidies or assistance to lower your insurance costs.

Remember, this information is for general guidance. Individual circumstances may greatly affect your specific costs and available options. Always obtain personalized quotes from multiple insurance providers and carefully review all policy details before enrolling. Contacting a qualified insurance agent can also be immensely helpful in finding the best plan for your family in South Holland, IL.

Streamlining the Process: Getting a Health Insurance Quote

This section will guide you through obtaining a health insurance quote from Idris Valentine Health Insurance Agency in South Holland, Illinois, and help you understand the key factors influencing your premiums. The process is straightforward, but understanding the variables involved will empower you to make informed decisions. We’ll break down the steps and provide examples to illustrate how to get the best possible coverage at a price that fits your budget.

Understanding Your Needs

Before requesting a quote, it’s crucial to assess your individual healthcare needs. Consider factors such as your age, health status, family size, and desired level of coverage. Do you require extensive medical care or are you generally healthy? Do you have pre-existing conditions? Answering these questions helps you choose the right plan.

For instance, a young, healthy individual might be comfortable with a high-deductible plan with a lower monthly premium. Conversely, a family with pre-existing conditions would likely benefit from a plan with lower deductibles and co-pays, even if it means higher monthly premiums. This is a critical step in determining your ideal plan and securing the appropriate insurance quotes.

Obtaining a Quote from Idris Valentine Health Insurance Agency

Idris Valentine Health Insurance Agency, located in South Holland, Illinois, offers a variety of health insurance plans. To obtain a quote, you can visit their office, call them directly, or explore their online options, if available. Remember to have the following information ready:

- Your date of birth

- Your address

- Information about your employer (if applicable)

- Details about your family members (if you’re seeking family coverage)

- Information on pre-existing conditions (if applicable)

Let’s assume for illustrative purposes that Idris Valentine offers quotes through a user-friendly online portal. This portal allows users to input their details and instantly receive several plan options. The website’s hypothetical address is: [Insert Hypothetical Website Address Here]. Their hypothetical phone number is: (Insert Hypothetical Phone Number Here). Their hypothetical mailing address is: [Insert Hypothetical Mailing Address Here].

Comparing Insurance Quotes and Premiums

Once you’ve received your insurance quotes, it’s essential to compare them thoroughly. Don’t solely focus on the monthly premiums. Carefully examine the following aspects:

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Copay: The fixed amount you pay for a doctor’s visit or other services.

- Coinsurance: Your share of the costs after you’ve met your deductible.

- Out-of-pocket maximum: The maximum amount you’ll pay in a year.

Below is an example comparison table, using hypothetical data for three different plans from Idris Valentine and a competitor, “Example Insurance Company”:

Example Insurance Plan Comparison

| Feature | Idris Valentine Plan A | Idris Valentine Plan B | Idris Valentine Plan C | Example Insurance Company Plan X |

|---|---|---|---|---|

| Monthly Premium | $250 | $375 | $500 | $300 |

| Deductible | $1,000 | $500 | $0 | $2,000 |

| Copay (Doctor Visit) | $30 | $25 | $20 | $40 |

| Coinsurance | 20% | 15% | 10% | 25% |

| Out-of-pocket Max | $5,000 | $4,000 | $3,000 | $6,000 |

This table highlights that while Plan A has the lowest monthly premium, it also has a high deductible. Plan C offers the most comprehensive coverage but comes with a higher premium. The comparison allows you to weigh the trade-offs between cost and coverage. Remember, these are hypothetical examples; actual quotes will vary based on your individual circumstances.

Factors Affecting Your Premiums

Several factors influence the cost of your health insurance premiums. These include:

- Age: Older individuals generally pay higher premiums due to an increased risk of healthcare needs.

- Location: Premiums can vary based on geographic location due to differences in healthcare costs.

- Tobacco Use: Smokers typically pay higher premiums due to increased health risks.

- Health Status: Individuals with pre-existing conditions might face higher premiums.

- Plan Type: Different plan types (e.g., HMO, PPO) have varying cost structures.

Understanding these factors helps you anticipate the cost of your insurance and prepare accordingly. It’s crucial to accurately represent your health status and lifestyle when requesting a quote for the most accurate pricing.

Additional Resources and Support

While this guide provides a solid foundation, obtaining a personalized insurance quote from Idris Valentine or any other reputable insurer is essential. Remember to carefully review all plan details, including the summary of benefits and coverage, before making a decision. Don’t hesitate to ask questions; insurance professionals are there to help you navigate the process. For further information on health insurance options in Illinois, consider contacting the Illinois Department of Insurance. Remember to explore resources provided by Healthcare.gov for additional information and understanding of your healthcare options.

Remember to always contact Idris Valentine Health Insurance Agency directly for the most current and accurate information.

Crucial Frequently Asked Questions (FAQ) (mentioning Semantic Entities: Clients)

This section addresses common questions our clients have regarding health insurance plans and services offered through Idris Valentine Health Insurance Agency in South Holland, Illinois. We aim to provide clear, concise answers to help you make informed decisions about your healthcare coverage.

What types of health insurance plans does Idris Valentine Health Insurance Agency offer?

Idris Valentine Health Insurance Agency offers a comprehensive range of health insurance plans to cater to diverse needs and budgets. We work with several leading insurance providers, including Aetna, Anthem, and Blue Cross Blue Shield (availability may vary). These plans typically include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and EPOs (Exclusive Provider Organizations). We also assist with Medicare and Medicaid enrollment. Our agents can help you determine which plan best suits your individual health needs and financial situation. We pride ourselves on providing personalized service to each client.

What is the average cost of health insurance through Idris Valentine Health Insurance Agency?

The cost of health insurance varies significantly based on several factors, including age, location, chosen plan (HMO, PPO, EPO), coverage level (bronze, silver, gold, platinum), and pre-existing conditions. It’s impossible to give a single average cost. However, we can provide you with a hypothetical example to illustrate cost variations.

Hypothetical Example of Monthly Premiums:

| Plan Type | Age 30 | Age 50 | Age 70 |

|---|---|---|---|

| Bronze Plan | $250 | $400 | $600 |

| Silver Plan | $350 | $550 | $800 |

| Gold Plan | $500 | $750 | $1100 |

Please note: These are purely hypothetical figures. Actual costs will vary depending on the factors mentioned above. Contact us for a personalized quote.

How can I get a quote for health insurance through Idris Valentine Health Insurance Agency?

Getting a quote is easy! You can either visit our office at [Insert Address Here], call us at (815) 555-1212, or visit our website at [Insert Website Here]. Our team is available to answer your questions, help you understand your options, and provide a personalized quote tailored to your specific needs. We make the process straightforward and stress-free. We understand that choosing a health insurance plan can be complex, and we’re dedicated to simplifying the process for you.

What documents do I need to provide when applying for health insurance through your agency?

To apply for health insurance, you’ll typically need to provide some basic personal information, including your full name, date of birth, Social Security number, and current address. You may also need to provide information about your employment, income, and family members who will be covered under the plan. We will guide you through the required documentation during the application process. Rest assured, we handle all client information with the utmost confidentiality and adhere to strict privacy regulations.

Does Idris Valentine Health Insurance Agency offer assistance with Medicare or Medicaid enrollment?

Yes, absolutely! We have extensive experience assisting clients with both Medicare and Medicaid enrollment. We can help you understand the nuances of each program, choose the right plan for your needs, and navigate the enrollment process. We are knowledgeable about the various options available and can guide you through the often-complicated process, ensuring a smooth and hassle-free experience.

What are the steps involved in getting health insurance through your agency?

- Initial Consultation: We’ll have a conversation to understand your needs and preferences.

- Plan Selection: We’ll help you choose a plan that fits your budget and health requirements.

- Application Completion: We’ll assist you in completing the necessary paperwork.

- Enrollment: We’ll submit your application to the insurance provider.

- Follow-up: We’ll follow up to ensure a smooth enrollment and address any questions you may have.

We handle every step, reducing stress and ensuring a smooth process.

How do I file a claim with my health insurance provider after receiving services?

The process of filing a claim depends on your chosen plan. However, in most cases, you’ll need to submit a claim form along with any relevant medical documentation (e.g., bills, explanation of benefits). We can provide detailed instructions and support you in navigating the claims process. We’re committed to helping you throughout the entire process, from choosing a plan to managing your claims. Don’t hesitate to reach out to us if you need assistance with any aspect of your health insurance.

What are the cancellation policies if I need to cancel my health insurance plan?

Cancellation policies vary depending on the insurance provider and the specific plan. Generally, there are deadlines and procedures to follow. We will clearly outline these policies for you at the time of enrollment and will guide you through the process should you need to cancel your plan. We are transparent in all our dealings with our clients and always strive to help them make the best choices for their circumstances.

What is the process for updating my personal information (address, phone number, etc.)?

To update your personal information, simply contact our office at (815) 555-1212 or email us at [Insert Email Here]. Providing updated information ensures accurate and efficient service. We maintain client data with utmost care to prevent any issues. This helps us avoid delays or errors in processing your claims and ensuring a smooth experience.

Comparison of Hypothetical Health Insurance Plans from Different Providers

This table shows a hypothetical comparison of monthly premiums for different plans from different providers. Remember these are hypothetical values for illustrative purposes only. Actual costs will vary based on many factors.

| Plan Type | Provider A (Hypothetical) | Provider B (Hypothetical) | Provider C (Hypothetical) |

|---|---|---|---|

| Bronze Plan | $275 | $250 | $300 |

| Silver Plan | $400 | $375 | $425 |

| Gold Plan | $550 | $525 | $600 |

This information is for illustrative purposes only and does not represent actual costs. Contact us for accurate quotes.