Esteban Garza Health Insurance in Romney West Virginia

10 reviews

10 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Esteban Garza Health Insurance in Romney West Virginia

Esteban Garza Health Insurance: Your Trusted Partner for Healthcare Coverage in Romney, WV

Navigating the Complexities of Health Insurance

Finding the right health insurance plan can be challenging. With numerous options and ever-changing regulations, it’s easy to feel overwhelmed. That’s where Esteban Garza Health Insurance steps in. We’re committed to simplifying the process, providing personalized guidance and support to help you secure the best possible healthcare coverage.

Understanding Your Needs

We begin by understanding your individual requirements. Our comprehensive consultation process involves discussions about your health needs, lifestyle, budget, and coverage preferences. This personalized approach ensures that we recommend plans perfectly tailored to your specific circumstances.

A Wide Range of Plan Options

We work with a network of leading insurance providers, offering a wide array of plans to cater to diverse needs and budgets. Whether you’re looking for a comprehensive plan with extensive coverage or a more economical option, we’ll present a range of possibilities to help you make an informed decision.

Expert Guidance and Support

We don’t just sell insurance; we provide ongoing support and guidance. We’re available to answer your questions, address concerns, and ensure that you fully understand your chosen plan. Our expertise extends beyond simply selecting a plan; we ensure you remain informed and confident in your healthcare coverage throughout the year.

Commitment to Local Communities

As a local agent, we have an in-depth understanding of the Romney community and the specific healthcare needs of its residents. We leverage this knowledge to offer personalized recommendations, connecting you with local doctors and specialists within your chosen plan’s network. This local focus empowers us to provide truly relevant and beneficial solutions for you.

A Transparent and Trustworthy Approach

Transparency and trust are paramount to our business philosophy. We provide clear and straightforward explanations of plan details, avoiding complex jargon that can often confuse individuals. We strive to build long-term relationships with our clients, based on trust and a commitment to providing exceptional service.

Contact Esteban Garza Health Insurance today

Don’t navigate the health insurance maze alone. Contact Esteban Garza Health Insurance and let us help you find the perfect plan for your needs. We’re dedicated to assisting you in securing affordable, reliable, and comprehensive healthcare coverage.

Products we offer:

Recent reviews

Our team

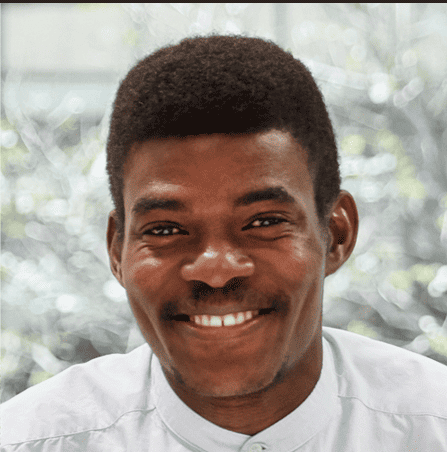

Esteban Garza

Lead Insurance Agent

Maria Sanchez

Client Services Manager

David Thompson

Insurance SpecialistFrequently asked questions

Esteban Garza Health Insurance in Romney, West Virginia: Your Comprehensive Guide

Understanding Your Health Insurance Needs in Romney, WV

Finding the right health insurance plan can feel overwhelming. With so many options and ever-changing regulations, it’s easy to feel lost. But don’t worry, we’re here to guide you through the process. This comprehensive guide focuses on Esteban Garza Health Insurance in Romney, West Virginia, offering detailed information and insights to help you make informed decisions about your healthcare coverage. We’ll cover everything from understanding your options to choosing the best plan for your individual needs.

Navigating the Maze of Health Insurance Plans

The world of health insurance is complex, with a variety of plans offering different levels of coverage. Understanding the nuances of HMOs, PPOs, and EPOs is crucial to selecting the right fit. We’ll break down the key differences, highlighting the advantages and disadvantages of each type of plan to ensure you make the choice that best aligns with your healthcare preferences and financial situation. Think of it as your personal roadmap to understanding health insurance jargon and selecting the best option for your unique circumstances. We’ll also discuss the critical aspects of deductibles, co-pays, and out-of-pocket maximums, helping you understand the financial implications of each plan.

Decoding Health Insurance Terminology: A Glossary for Consumers

Health insurance is filled with technical terms that can be confusing even for seasoned healthcare professionals. This section will serve as a glossary, defining key terms like premium, deductible, copay, coinsurance, and out-of-pocket maximum. We’ll provide real-world examples to illustrate each term and clarify how these elements contribute to the overall cost of your health insurance. Understanding this terminology is the first step toward making informed decisions about your healthcare coverage. We aim to demystify the complexities of health insurance, making it easier for you to understand and manage your healthcare expenses.

Finding the Right Health Insurance Provider in Romney, WV

Choosing the right health insurance provider is a pivotal decision, directly impacting your access to quality healthcare and the overall cost of your coverage. This section explores factors to consider when evaluating different providers. We’ll discuss provider networks, customer service reputation, and plan options to help you narrow down your choices and find a provider that aligns perfectly with your health and financial goals. Remember, selecting a provider isn’t just about cost; it’s also about finding a company you can trust to support your healthcare needs.

Evaluating Provider Networks: Access to Doctors and Specialists

The provider network is the cornerstone of your health insurance plan. This network encompasses the doctors, specialists, and hospitals covered by your insurance. Choosing a plan with a broad network gives you greater flexibility in selecting healthcare providers. Consider whether you need specific specialists or prefer in-network care for convenient access and cost-effective services. A comprehensive network can prevent unnecessary out-of-pocket expenses, making healthcare more affordable and accessible. It’s essential to thoroughly research and understand the network’s geographical reach and the specific healthcare professionals covered under your plan.

The Importance of Customer Service and Plan Options

Exceptional customer service can make all the difference when navigating the complexities of health insurance. A responsive and helpful provider can quickly resolve issues, answer questions, and provide support when you need it most. Look for providers with a strong track record of customer satisfaction and easy-to-access customer service channels. A comprehensive provider should offer various plans that cater to diverse healthcare and financial needs. Comparing different plan options, including their coverage levels and associated premiums, can greatly impact your decision-making process and your financial well-being.

Esteban Garza Health Insurance: A Closer Look

Esteban Garza Health Insurance likely operates within the broader framework of a larger insurance company, potentially acting as an independent agent or representing multiple providers. This section will analyze the specific services and advantages offered by Esteban Garza Health Insurance in Romney, WV. We will explore their commitment to customer satisfaction and their ability to provide tailored solutions for individuals and families.

Understanding the Services Offered by Esteban Garza

The specific services offered will vary, but you can expect personalized assistance in selecting a health insurance plan that suits your individual circumstances. This may involve comparing plans from various insurers, answering your questions, and guiding you through the enrollment process. A reputable agent will provide ongoing support, ensuring you understand your policy and can access the necessary resources. A personalized approach is paramount; they should take the time to understand your unique needs before suggesting a plan, ensuring a comfortable and informed decision-making experience.

The Benefits of Working with a Local Agent

Working with a local agent like Esteban Garza offers several advantages. Local agents have an in-depth understanding of the local healthcare landscape and can often provide personalized recommendations based on your specific needs and the local healthcare providers. They serve as a direct point of contact, readily available to answer questions and address concerns. This personal touch can be invaluable, simplifying the often-confusing process of obtaining health insurance. The local expertise provides a level of convenience and personalized support that is often absent when dealing with large national insurance companies directly. They bridge the gap between complex insurance policies and the average consumer’s needs.

Finding the Best Plan for Your Needs

Selecting the right health insurance plan is a crucial decision that depends entirely on individual circumstances. This section details the essential steps to take when choosing a plan. It emphasizes considering factors like your health status, budget, and desired level of coverage. Careful consideration of these factors ensures your chosen plan meets your specific requirements and aligns with your financial capabilities.

Assessing Your Health Needs and Budget

Before you begin comparing plans, honestly assess your current health status and anticipated healthcare needs in the coming year. Do you have any pre-existing conditions? Do you anticipate needing frequent medical attention? These questions will help you determine the level of coverage you require. Simultaneously, establish a realistic budget for your monthly premiums and out-of-pocket expenses. Balancing your health needs with your financial capacity will streamline the selection process. Understanding your financial limitations ensures that you avoid overspending on coverage that is beyond your means while still securing adequate health protection.

Comparing Plans and Making Your Decision

Once you’ve assessed your needs and budget, start comparing plans offered by different providers. Utilize online comparison tools or consult with a local agent like Esteban Garza to efficiently assess your options. Carefully review the details of each plan, paying close attention to premiums, deductibles, co-pays, and out-of-pocket maximums. Don’t hesitate to ask questions and clarify any aspects of the plans that remain unclear. Selecting the most suitable plan requires careful consideration of these factors, combined with a thorough understanding of your individual needs and financial capabilities. Making an informed decision ensures peace of mind knowing you have appropriate healthcare coverage tailored to your unique circumstances.

Frequently Asked Questions (FAQs)

What are the key differences between HMOs, PPOs, and EPOs?

HMOs offer limited networks and require referrals for specialist visits, while PPOs provide greater flexibility with broader networks and no referral requirements. EPOs combine elements of both but may not cover out-of-network services.

How do I determine my out-of-pocket maximum?

Your out-of-pocket maximum is the highest amount you’ll pay for covered healthcare services in a plan year. It’s usually specified in your policy documents.

What are the consequences of missing a deadline to enroll in a health insurance plan?

Missing enrollment deadlines could result in a gap in coverage, potentially leading to higher costs if you need healthcare during that period. You may have to wait for the next open enrollment period.

How can I find local healthcare providers within my insurance network?

Most insurers provide online directories or tools to search for in-network doctors, specialists, and hospitals within your geographical area. Check your insurer’s website or app.

What happens if I need to change my health insurance plan during the year?

There are limited circumstances where you can change your plan outside of the open enrollment period, such as qualifying life events (e.g., marriage, job loss). Consult your insurer or agent for specific guidance.