Eithan George Health Insurance Agency in Fort Valley Georgia

7 reviews

7 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Eithan George Health Insurance Agency in Fort Valley Georgia

Eithan George Health Insurance Agency: Your Trusted Local Partner

Eithan George Health Insurance Agency is your premier destination for comprehensive health insurance solutions in Fort Valley, Georgia. We’re more than just an insurance agency; we’re your dedicated partners in securing your healthcare future. We understand the complexities of the health insurance market and are committed to simplifying the process for you, providing personalized guidance and unwavering support every step of the way.

Our Mission

Our mission is to empower individuals and families in Fort Valley and the surrounding communities with the knowledge and resources necessary to make informed decisions about their health insurance. We strive to deliver exceptional customer service, ensuring a seamless and stress-free experience from initial consultation to ongoing support.

Personalized Service

We believe in the power of personalized service. Unlike larger, impersonal agencies, we take the time to understand your specific needs, circumstances, and preferences. We work closely with you to assess your healthcare utilization, budget constraints, and preferred healthcare providers to create a tailored plan that aligns perfectly with your unique requirements.

Comprehensive Guidance

Our team of experienced insurance professionals possesses the expertise to navigate the intricacies of the health insurance market. We’ll explain complex terms in clear, concise language, helping you understand your options and make confident decisions. We’ll guide you through every step of the process, from plan selection to enrollment and ongoing claims assistance.

Unwavering Support

Our commitment to you doesn’t end with enrollment. We’re here to provide ongoing support, assisting you with any questions or concerns you may have throughout the year. We’ll be your reliable resource for resolving claims issues, navigating policy changes, and ensuring you receive the care you need when you need it.

Community Involvement

We’re proud members of the Fort Valley community and are actively involved in supporting local initiatives. We believe in giving back to the community that supports us.

Contact Us Today

We invite you to contact us today for a free consultation. Let us help you find the perfect health insurance plan that provides comprehensive coverage, peace of mind, and financial security. Don’t hesitate to reach out – your healthcare future is our priority.

Products we offer:

Recent reviews

Our team

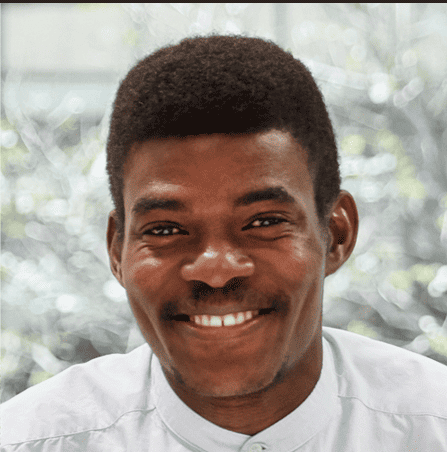

Eithan George

Agency Owner & Lead Insurance AgentEithan has over 15 years of experience in the insurance industry, specializing in health insurance. He holds multiple professional certifications and is passionate about providing personalized service to his clients.

Sarah Miller

Senior Insurance AgentSarah is a highly experienced insurance agent with a strong focus on customer satisfaction. She has a knack for simplifying complex insurance concepts and providing personalized guidance to clients.

David Johnson

Client Services ManagerDavid oversees client services, ensuring all clients receive prompt and efficient assistance. He's dedicated to creating a seamless and stress-free experience for every client.

Frequently asked questions

Eithan George Health Insurance Agency in Fort Valley, Georgia: Your Trusted Partner for Health Coverage

Understanding Your Health Insurance Needs in Fort Valley, GA

Navigating the world of health insurance can feel overwhelming. With so many plans, providers, and terms to understand, it’s easy to feel lost. At Eithan George Health Insurance Agency, we understand this. We’re here to simplify the process and help you find the perfect health insurance plan tailored to your specific needs and budget in Fort Valley, Georgia. We don’t just sell policies; we build relationships, offering personalized guidance and support every step of the way. We believe in empowering you with knowledge so you can make informed decisions about your healthcare future. This comprehensive guide will walk you through the essentials of health insurance in Fort Valley and how we can help.

Choosing the Right Health Insurance Plan

The market offers a variety of health insurance plans, each with its own set of features and costs. Understanding the differences between HMOs, PPOs, and EPOs is crucial. An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician (PCP) who coordinates your care. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see out-of-network providers, albeit at a higher cost. EPOs (Exclusive Provider Organizations) are similar to HMOs but usually do not allow out-of-network care except in emergencies. We’ll assess your healthcare utilization, preferred doctors, and budget to determine the best plan for you. Do you prefer the convenience of an in-network system, or are you willing to pay more for greater flexibility? These are crucial questions we’ll explore together.

Understanding Deductibles, Co-pays, and Coinsurance

Beyond plan types, understanding the financial aspects of your health insurance is vital. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Co-pays are fixed fees you pay for doctor visits or other services. Coinsurance is the percentage you pay after meeting your deductible. We’ll explain these terms clearly, ensuring you understand the financial implications of each plan option. What’s your comfort level with out-of-pocket expenses? How much are you willing to pay upfront versus having lower monthly premiums? These considerations heavily impact plan selection. We will help you evaluate this carefully.

Finding Affordable Health Insurance in Fort Valley, GA

Finding affordable health insurance is a top priority for many. We work with numerous insurance providers to offer a range of plans at various price points. We’ll explore options such as Marketplace plans (through the Affordable Care Act), employer-sponsored plans, and private insurance options. Understanding the subsidies and tax credits available to you will also play a significant role in finding the most affordable yet comprehensive coverage.

Government Subsidies and Tax Credits

The Affordable Care Act (ACA) offers subsidies and tax credits to individuals and families who meet certain income requirements. These subsidies can significantly reduce the cost of health insurance, making it more accessible to those who otherwise might struggle to afford it. We’ll help you determine your eligibility and guide you through the application process. Don’t assume you’re ineligible! Many people are surprised by the level of assistance available. We will help you explore every possibility.

Comparing Plans and Costs

We utilize advanced comparison tools to analyze different plans side-by-side, allowing us to clearly highlight the differences in premiums, deductibles, co-pays, and out-of-pocket maximums. This transparent approach lets you make an informed decision based on your financial situation and health needs. You deserve to understand exactly what you’re paying for, and why. We will break it down for you in simple terms.

Navigating the Health Insurance Marketplace in Georgia

The Georgia health insurance marketplace can be complex. We’re here to simplify it. We’ll help you understand the enrollment periods, deadlines, and necessary documentation. We’ll also navigate any potential challenges or roadblocks you might encounter during the enrollment process, ensuring a smooth and stress-free experience.

Open Enrollment Periods

Understanding the open enrollment periods for both the Marketplace and private insurance plans is essential. Missing these windows can mean delaying your coverage, so staying informed is key. We’ll keep you updated on important deadlines and assist you with the timely submission of all required documents. Don’t let a missed deadline jeopardize your health coverage! We’re here to ensure you’re protected.

Special Enrollment Periods

In certain circumstances, such as a life event like marriage, divorce, or the birth of a child, you may qualify for a Special Enrollment Period, allowing you to enroll outside of the regular open enrollment period. We’ll assess your specific circumstances to determine if you qualify for a Special Enrollment Period.

Eithan George Health Insurance Agency: Your Local Experts

We’re more than just an insurance agency; we’re your trusted partners in securing your healthcare future. We pride ourselves on providing personalized service, comprehensive guidance, and unwavering support. Our team is dedicated to understanding your specific needs and finding the perfect plan to fit your budget and lifestyle. We believe in building lasting relationships based on trust, transparency, and mutual respect.

Our Commitment to Client Success

Your success is our success. We’re committed to providing you with the best possible health insurance coverage, ensuring peace of mind and financial security. We don’t just sell insurance; we build relationships, offering ongoing support and guidance even after you’ve chosen your plan.

Contact Us Today!

We invite you to contact us today for a free consultation. We’ll answer all your questions and guide you through the process of finding the right health insurance plan for you and your family. Don’t wait until you need it – protect your health and your financial well-being by securing comprehensive coverage.

Frequently Asked Questions (FAQs)

What types of health insurance plans do you offer?

We offer a wide range of plans, including HMOs, PPOs, EPOs, and other options tailored to individual needs and budgets.

What is the cost of your services?

Our services are typically free to clients. We are compensated by the insurance companies, not by you.

What are the required documents for enrollment?

We will let you know exactly what documents are needed once you contact us; requirements vary depending on your chosen plan.

What is your coverage area?

We primarily serve Fort Valley and the surrounding areas in Georgia.

How long does the enrollment process take?

The enrollment process typically takes a few days to a couple of weeks, depending on the plan and individual circumstances.