Danny Wyatt Health Insurance in Norman Oklahoma

8 reviews

8 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Danny Wyatt Health Insurance in Norman Oklahoma

Danny Wyatt Health Insurance: Your Trusted Partner in Norman, OK

Commitment to Excellence: At Danny Wyatt Health Insurance, we’re more than just an insurance agency; we’re your partners in health. We understand that navigating the complex world of health insurance can be daunting, which is why we’re dedicated to providing personalized service and expert guidance to our valued clients in Norman and the surrounding areas. Our team possesses extensive knowledge of the local healthcare landscape, enabling us to connect you with the right providers and plans that perfectly meet your unique needs. We take the time to listen, understand your concerns, and explain options in plain language, so you feel confident and empowered in your decisions.

Personalized Service, Tailored Solutions

Individual Needs First: We believe in a client-centric approach. Your specific requirements, budget, and health circumstances guide our recommendations. Whether you’re a young adult, a family with children, or a senior citizen, we tailor our strategies to your situation. We don’t believe in one-size-fits-all solutions. We meticulously research various plans available in the Norman area, comparing benefits, premiums, and coverage specifics to ensure that you receive the optimal value for your investment.

Expertise and Experience

Extensive Knowledge Base: Our team comprises highly experienced and licensed insurance professionals who stay up-to-date on industry regulations and policy changes. This expertise ensures you receive accurate and comprehensive advice. We pride ourselves on our intimate understanding of local healthcare providers and networks, giving us a competitive edge in finding the best match for your healthcare needs.

Navigating the Oklahoma Health Insurance Landscape

Understanding the Nuances: Oklahoma’s health insurance market has its unique features, and we’re deeply familiar with its intricacies. We can navigate the complexities of the Affordable Care Act (ACA) and assist you in selecting a plan that complies with all relevant regulations. We’ll demystify jargon and explain the essential components of each plan, including premiums, deductibles, co-pays, and out-of-pocket maximums, in a clear and concise manner.

Comprehensive Range of Products

Your One-Stop Shop: We offer a wide variety of health insurance plans to suit diverse needs and budgets. We work with leading insurance providers in Oklahoma, allowing us to offer comprehensive coverage options. We’re not limited to a single provider and will always strive to find the best coverage at the best possible price. Our goal is to be your one-stop shop for all your health insurance needs.

Beyond Insurance: Building Relationships

Long-Term Partnership: At Danny Wyatt Health Insurance, we aim to establish long-term relationships with our clients. We’re not just here during open enrollment; we’re committed to supporting you throughout the year. Whether you have questions, need adjustments to your plan, or require assistance filing claims, we’re readily available to assist. We’re a proactive partner, not just a reactive service provider.

Products we offer:

Recent reviews

Our team

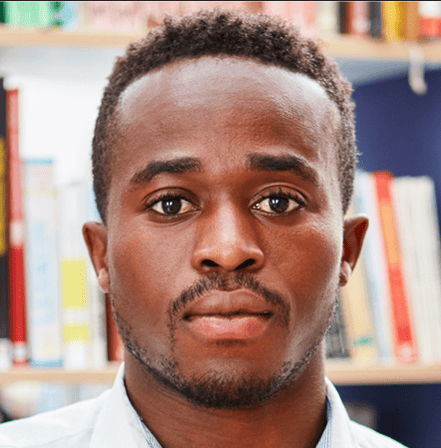

Danny Wyatt

Owner and Lead Agent

Sarah Miller

Senior Insurance Agent

John Thompson

Customer Service RepresentativeFrequently asked questions

Danny Wyatt Health Insurance in Norman, Oklahoma: Your Comprehensive Guide

Understanding Your Health Insurance Needs in Norman, Oklahoma

Choosing the right health insurance plan can feel overwhelming. With so many options available, it’s crucial to understand your individual needs and preferences before making a decision. This comprehensive guide will walk you through the intricacies of health insurance in Norman, Oklahoma, focusing on the expertise and services offered by Danny Wyatt Insurance.

Factors to Consider When Choosing a Health Insurance Plan

Several factors influence the ideal health insurance plan for you. Your age, pre-existing conditions, family size, and budget all play significant roles. Do you need extensive coverage for chronic illnesses or preventative care? Are you comfortable with higher deductibles for lower premiums, or do you prefer lower deductibles and higher premiums? Understanding these factors allows you to make an informed choice.

Analyzing Your Healthcare Spending Habits

Before comparing plans, take a look at your past healthcare spending. How often do you visit the doctor? Do you regularly require prescription medications? Analyzing this information helps you anticipate potential costs and choose a plan that aligns with your healthcare utilization patterns. This proactive approach can prevent unexpected financial burdens.

Navigating the World of Health Insurance Providers in Norman

Norman, Oklahoma boasts a diverse range of health insurance providers. Understanding the distinctions between these providers—from large national corporations to smaller, locally-owned agencies like Danny Wyatt Insurance—is crucial for finding the perfect fit. Each offers unique strengths and caters to different preferences.

The Benefits of Working with a Local Insurance Agent

Local agents, like those at Danny Wyatt Insurance, offer a personalized touch. They provide in-depth knowledge of the local healthcare landscape and can connect you with providers in the Norman area. Their personalized approach ensures your specific needs are addressed, a stark contrast to impersonal online-only interactions. This local expertise is invaluable.

Building a Relationship with Your Insurance Agent

Building a strong relationship with your local agent is essential. They can guide you through changes in your coverage needs over time, providing consistent support and advice. This personalized approach fosters trust and ensures you are always adequately protected.

Danny Wyatt Health Insurance: Expertise and Personalized Service

Danny Wyatt Health Insurance stands out for its commitment to personalized service and in-depth understanding of the Norman, Oklahoma, community. Their team of experienced agents dedicates itself to finding the perfect health insurance plan tailored to your specific requirements. They prioritize client satisfaction above all.

Understanding Danny Wyatt’s Approach to Client Care

Danny Wyatt Insurance employs a client-centric approach. They listen attentively to your needs, answer your questions thoroughly, and guide you through the sometimes-complex process of selecting a health insurance plan. This personalized approach builds trust and ensures you feel confident in your choice.

The Value Proposition of Choosing Danny Wyatt

Choosing Danny Wyatt Insurance means choosing peace of mind. You gain access to experienced agents who will advocate for you, ensuring you receive the best possible coverage at a competitive price. This personalized approach is invaluable in navigating the complexities of the health insurance market.

Key Features of Health Insurance Plans in Oklahoma

Understanding the key features of health insurance plans is paramount to making an informed decision. This section explores essential aspects like premiums, deductibles, co-pays, and out-of-pocket maximums, all crucial elements of any health insurance policy.

Understanding Premiums, Deductibles, and Co-pays

Premiums are your regular monthly payments for insurance coverage. Deductibles are the amount you pay out-of-pocket before your insurance begins to cover expenses. Co-pays are fixed amounts you pay for doctor visits or other services. Understanding these terms helps you choose a plan that fits your budget and healthcare needs.

Out-of-Pocket Maximums and Other Important Considerations

The out-of-pocket maximum is the most you will pay in a year for covered services. Once you reach this maximum, your insurance company covers 100% of your expenses. Other crucial factors include network providers and prescription drug coverage, all vital aspects to consider when selecting a plan.

Choosing the Right Plan Based on Your Needs

With a clearer understanding of the different aspects of health insurance, you can start matching your needs to available plans. This section offers guidance to help you make the right choice for your circumstances.

Matching Your Healthcare Needs with Available Plans

Consider your healthcare utilization patterns. If you frequently visit the doctor or require regular medication, a plan with lower deductibles and co-pays might be beneficial. If you are generally healthy and only require occasional checkups, a higher deductible plan with lower premiums could be a more cost-effective option.

Understanding Your Coverage Options and Plan Types

Different plans offer varying levels of coverage, including HMOs, PPOs, and POS plans. HMOs typically offer lower premiums but restrict you to in-network providers. PPOs allow you to see out-of-network providers, but premiums are usually higher. POS plans offer a hybrid approach. Understanding these distinctions is crucial for making the right choice.

Frequently Asked Questions (FAQs)

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician (PCP) who manages your care and refers you to specialists. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see any doctor without a referral, although out-of-network costs are higher.

How do I enroll in a health insurance plan?

Enrollment periods vary. You can enroll through the HealthCare.gov marketplace, a local insurance agent like Danny Wyatt Insurance, or directly through your employer (if offered).

What if I have a pre-existing condition?

The Affordable Care Act (ACA) prohibits insurers from denying coverage based on pre-existing conditions. However, pre-existing conditions may impact your premiums.

Can I change my health insurance plan during the year?

Generally, you can only change your plan during open enrollment periods, unless you qualify for a special enrollment period due to a qualifying life event (marriage, job loss, etc.).

What resources are available to help me understand my health insurance options?

You can consult your employer’s benefits department, local insurance agents, or online resources such as the HealthCare.gov website.

Conclusion

Selecting the right health insurance plan is a crucial decision. By understanding your needs, exploring your options, and working with a trusted local agent like Danny Wyatt Insurance, you can secure comprehensive coverage tailored to your specific circumstances. Remember, your health is your greatest asset, and protecting it is an investment worth making.