Aria Lindsey Health Insurance in Fall River Massachusetts

10 reviews

10 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Aria Lindsey Health Insurance in Fall River Massachusetts

Aria Lindsey Health Insurance: Your Fall River Partner for Healthcare Coverage

Finding the right health insurance can be a daunting task, but with Aria Lindsey Health Insurance, it doesn’t have to be. We understand the complexities of the healthcare system and are dedicated to helping you navigate the options and find a plan that perfectly fits your needs and budget. Based in the heart of Fall River, we are your neighbors and your trusted advisors when it comes to securing comprehensive healthcare coverage.

Our Commitment to You

We are committed to providing unparalleled service and support to our clients. Our goal is not simply to sell you a policy, but to build a long-term relationship based on trust and understanding. We take the time to listen to your concerns, answer your questions thoroughly, and provide personalized recommendations tailored to your specific circumstances. We are here to guide you through every step of the process, from initial consultation to ongoing claims management.

Understanding Your Needs

Before recommending a plan, we conduct a thorough needs analysis to understand your unique requirements. This involves considering factors such as your age, health status, family size, pre-existing conditions, preferred doctors, and budget. We leverage our deep understanding of the Fall River healthcare landscape to ensure that the plan we recommend provides access to the best local providers and facilities.

Expert Guidance and Support

Our experienced agents possess extensive knowledge of the various health insurance plans available in the Fall River area. We are adept at explaining complex terms in simple, easy-to-understand language, removing the confusion often associated with navigating the health insurance marketplace. We don’t just sell policies; we provide comprehensive guidance and support every step of the way.

Comprehensive Plan Options

We work with a range of reputable insurance providers, offering a diverse portfolio of plans to suit various needs and budgets. Whether you’re looking for a comprehensive HMO, a flexible PPO, or a cost-effective alternative, we have the expertise to help you find the right fit. We strive to ensure that you understand the intricacies of each plan and how it aligns with your individual requirements.

Ongoing Support and Claims Assistance

Our commitment extends beyond the initial policy selection. We provide ongoing support to help you manage your policy, address billing questions, and assist with claims processing. We are your advocates, working diligently to ensure you receive the benefits you deserve under your policy. We understand that navigating healthcare can be challenging, and we’re here to make the process smoother and less stressful for you.

Contact Us Today

Don’t wait until you need healthcare coverage to start planning. Contact Aria Lindsey Health Insurance today for a free consultation. Let us help you secure the peace of mind that comes with knowing you have the right health insurance protection for you and your family. We look forward to building a lasting relationship with you and helping you navigate the world of healthcare with confidence.

Products we offer:

Recent reviews

Our team

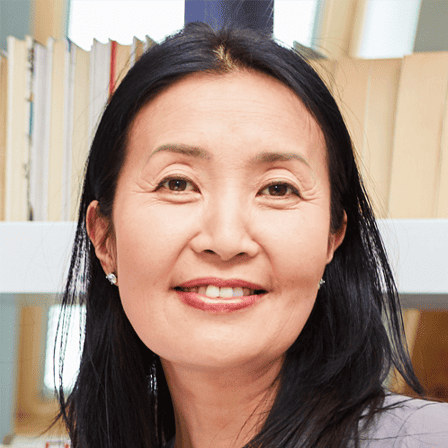

Aria Lindsey

CEO & FounderAria is a highly experienced insurance professional with over 20 years in the industry. She holds several professional designations and is deeply committed to providing her clients with the best possible care.

John Miller

Senior Insurance AgentJohn has over 15 years of experience assisting clients with their health insurance needs. He's known for his patient and thorough approach to explaining complex information.

Sarah Chen

Claims SpecialistSarah is a highly skilled claims specialist, ensuring seamless processing and support for our clients' claims.

Frequently asked questions

Aria Lindsey Health Insurance in Fall River, Massachusetts: Your Comprehensive Guide

Understanding Aria Lindsey Health Insurance in Fall River, MA

Finding the right health insurance can feel like navigating a maze. With so many options and confusing terminology, it’s easy to feel overwhelmed. This comprehensive guide will delve into the specifics of Aria Lindsey Health Insurance in Fall River, Massachusetts, providing you with the knowledge and resources you need to make informed decisions about your healthcare coverage. We’ll explore various plan types, cost considerations, and the essential role of a local agent in securing the best policy for your individual needs. Let’s begin by understanding the landscape of health insurance in Fall River.

Navigating the Health Insurance Marketplace in Fall River

Fall River, like many communities, offers a variety of health insurance options through different providers and marketplaces. Understanding the nuances of each plan—from HMOs to PPOs to EPOs—is crucial for making an educated choice. Factors such as your pre-existing conditions, preferred doctors, and budget will significantly influence the type of plan that best suits your circumstances. We’ll break down these plan types in detail, illustrating their pros and cons with real-world examples to ensure you have a crystal-clear understanding.

HMOs, PPOs, and EPOs: A Detailed Comparison

HMOs (Health Maintenance Organizations) typically require you to choose a primary care physician (PCP) who then refers you to specialists within the network. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see out-of-network doctors but at a higher cost. EPOs (Exclusive Provider Organizations) are a hybrid model, allowing you to see in-network doctors without a referral but restricting access to out-of-network providers entirely. Choosing the right plan depends on your individual healthcare needs and preferences. Let’s illustrate this with an example: Imagine you have a specific specialist you wish to continue seeing. A PPO might be the most suitable option for you, providing the flexibility to maintain your relationship with your preferred specialist, even if they are out of network.

The Importance of a Local Health Insurance Agent

In the complex world of health insurance, having a knowledgeable and experienced local agent can be invaluable. An agent acts as your personal advocate, navigating the intricacies of policy selection and ensuring you obtain the optimal coverage for your needs. They provide personalized guidance, explain complex terms in plain language, and help you compare plans effectively. Think of your agent as your trusted guide, expertly leading you through the process of securing the right health insurance for you and your family.

Finding the Right Agent in Fall River

Selecting the right insurance agent is just as important as choosing the right plan. Look for an agent with proven experience in the Fall River area, strong client testimonials, and a reputation for integrity and responsiveness. Inquire about their expertise in various insurance plans and their understanding of the local healthcare providers. Remember, a proactive and knowledgeable agent can prevent many of the headaches associated with choosing and managing health insurance. Take your time to research and interview potential agents to find the perfect fit for your needs.

The Value of Personalized Advice and Support

An experienced agent will provide personalized advice tailored to your specific situation. They will consider factors like your age, health history, family size, and financial constraints to recommend the most suitable plans. Beyond the initial policy selection, an agent offers ongoing support, helping you manage claims, address billing issues, and navigate changes in your healthcare circumstances. This level of personalized support is invaluable, offering peace of mind and reducing stress during potentially difficult times. Think of them as your personal healthcare advocate, always ready to assist you.

Aria Lindsey Health Insurance: A Closer Look

While we can’t provide specific details about Aria Lindsey Health Insurance without more information, we can discuss the general aspects of choosing a health insurance provider. Reputation, financial stability, network size, and customer service are all crucial factors to consider when choosing your insurer. Researching online reviews and checking the provider’s financial ratings will give you a better understanding of their reliability and overall performance.

Understanding Your Policy Documents

Once you have chosen a policy, thoroughly reviewing your policy documents is vital. Understanding your coverage details, deductibles, co-pays, and out-of-pocket maximums are crucial for managing your healthcare expenses effectively. Don’t hesitate to ask your agent to explain anything that you don’t fully grasp. Clarity in your understanding of your insurance policy will save you time, money, and potential headaches down the road.

Maximizing Your Healthcare Benefits

Understanding your policy benefits will allow you to maximize your healthcare spending. Taking advantage of preventive care services, understanding the process for filing claims, and learning about available cost-saving programs can significantly impact your overall healthcare costs. Proactive engagement with your insurance provider and agent can ensure you get the most out of your healthcare coverage.

Choosing the Right Health Insurance Plan for You

The ideal health insurance plan is highly personal and depends entirely on individual needs and circumstances. It’s a balance between cost, coverage, and access to healthcare providers. There is no one-size-fits-all solution; careful consideration of various factors is paramount to making the right choice.

Cost vs. Coverage: Finding the Right Balance

Balancing affordability with adequate coverage is often the most significant challenge. Higher premiums often come with lower out-of-pocket costs, while lower premiums may have higher deductibles and co-pays. Carefully weigh your financial situation against your healthcare needs to strike the optimal balance. Consider using online health insurance comparison tools to explore various options and compare their pricing and coverage details. This can help you visualize the costs associated with each plan and make a more informed decision.

Factors to Consider When Choosing a Plan

Several factors should inform your decision, including pre-existing conditions, preferred doctors, anticipated healthcare needs, and your budget. Understanding your individual healthcare requirements and aligning them with the features of different plans will ensure a seamless and cost-effective healthcare experience. Don’t hesitate to contact several providers for quotes and detailed plan information. This diligent approach will maximize your chances of finding the best possible option for your specific situation.

Frequently Asked Questions (FAQs)

What is the average cost of health insurance in Fall River, MA?

The average cost varies greatly based on factors like age, health status, and the plan chosen. Contacting local insurance agents for personalized quotes is recommended.

How can I find a doctor within my health insurance network?

Your insurance provider’s website typically has a doctor search tool where you can find in-network physicians and specialists.

What happens if I need care from an out-of-network provider?

Coverage for out-of-network providers depends on your plan type (HMO, PPO, EPO). PPOs usually cover out-of-network care, but at a higher cost. HMOs and EPOs generally don’t cover out-of-network care.

What is a deductible, and how does it work?

Your deductible is the amount you must pay out-of-pocket for healthcare services before your insurance coverage kicks in.

What are the steps to file a health insurance claim?

The process usually involves submitting forms and documentation to your insurance provider. Your insurance agent can guide you through the process.