Marlon Stephenson Health Insurance in Jim Thorpe Pennsylvania

9 reviews

9 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Marlon Stephenson Health Insurance in Jim Thorpe Pennsylvania

Marlon Stephenson Health Insurance: Your Trusted Partner in Jim Thorpe, PA

Exceptional Service: At Marlon Stephenson Health Insurance, we pride ourselves on providing personalized, exceptional service to every client. We understand that choosing the right health insurance can be a complex and overwhelming process, and we’re dedicated to simplifying that for you. We take the time to listen to your unique needs, answer all your questions thoroughly, and guide you through every step of the way. We aren’t just selling insurance; we’re building relationships based on trust and understanding.

Deep Local Knowledge

Understanding the Jim Thorpe Community: As a resident of Jim Thorpe, Marlon possesses an in-depth understanding of the local healthcare landscape. He knows the doctors, hospitals, and facilities in the area, allowing him to recommend plans that provide the best access to the care you need. This local expertise ensures that your insurance plan seamlessly integrates with your lifestyle and healthcare needs within the Jim Thorpe community.

Comprehensive Plan Options

A Wide Range of Choices: We offer a wide range of health insurance plans from reputable providers, ensuring that you have access to the best options available to suit your individual requirements and budget. Whether you’re looking for a comprehensive plan with extensive coverage or a more budget-friendly option, we can help you find the perfect fit. We work with many leading providers to offer a truly comprehensive selection of plans.

Personalized Guidance and Support

Your Dedicated Insurance Advisor: Marlon Stephenson serves as your dedicated insurance advisor, providing personalized guidance and support throughout the entire process. From initial consultations to enrollment and ongoing assistance, he’s always available to answer your questions and address any concerns. We’re committed to being your long-term partner in managing your health insurance.

Competitive Pricing and Value

Finding the Best Value for Your Money: We understand the importance of finding the right balance between comprehensive coverage and affordability. We’ll work diligently to find plans that offer excellent value for your money, ensuring that you receive the best possible coverage without breaking the bank. We believe in transparency and will provide you with a clear and detailed explanation of all costs involved.

Stress-Free Enrollment

Simplifying the Process: We handle all the paperwork and administrative tasks involved in the enrollment process, ensuring a smooth and stress-free experience. Our goal is to simplify the often overwhelming process of choosing health insurance, so you can focus on what matters most – your health and well-being.

Ongoing Support and Assistance

We’re Here to Help: Even after you’ve enrolled in a plan, we’re here to provide ongoing support and assistance. We can help you with claims, billing, and any other questions or concerns you might have. Our commitment to customer care extends beyond the initial enrollment process.

Contact Us Today!

Let Marlon Stephenson Health Insurance help you find the perfect health insurance plan for your needs in Jim Thorpe. Contact us today for a free consultation!

Products we offer:

Recent reviews

Our team

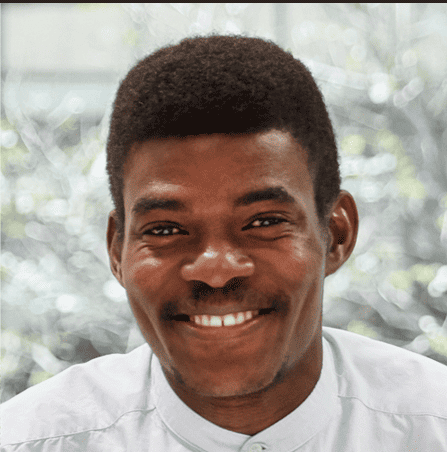

Marlon Stephenson

Insurance Agent & Owner

[Name]

Client Relations Manager

[Name]

Administrative AssistantFrequently asked questions

Marlon Stephenson Health Insurance in Jim Thorpe, Pennsylvania

Understanding Your Health Insurance Needs in Jim Thorpe, PA

Finding the right health insurance can feel overwhelming. With so many plans and options available, it’s easy to get lost in the details. But understanding your needs is the first crucial step. In Jim Thorpe, Pennsylvania, access to quality healthcare is paramount, and choosing the right insurance plan directly impacts your access to care and financial well-being. This comprehensive guide will walk you through the essential aspects of health insurance in Jim Thorpe, ensuring you’re equipped to make informed decisions.

Navigating the Maze of Health Insurance Plans

The health insurance landscape in Jim Thorpe, like elsewhere, is complex. You’ll encounter different plan types, each with its own advantages and disadvantages. Understanding HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and EPOs (Exclusive Provider Organizations) is vital. An HMO typically requires you to choose a primary care physician (PCP) who coordinates your care, offering lower premiums but limiting your choice of specialists. A PPO provides more flexibility, allowing you to see any doctor within or outside the network, though at a higher cost. EPOs fall somewhere in between, offering a balance of cost and choice. Consider your healthcare preferences and budget when deciding which plan best suits your needs in Jim Thorpe.

Choosing the Right Plan for Your Lifestyle in Jim Thorpe

Your lifestyle in Jim Thorpe heavily influences your health insurance needs. Are you a frequent visitor to specialists? Do you have pre-existing conditions? Do you prefer a specific hospital in the area? These factors play a significant role in determining which plan is most cost-effective and beneficial for you. For instance, if you anticipate needing frequent specialist visits, a PPO plan might be more suitable. Conversely, if you’re generally healthy and prefer a more managed approach to care, an HMO might be a better fit. Researching the network of doctors and hospitals covered by different plans within Jim Thorpe is essential.

Local Healthcare Providers in and Around Jim Thorpe, PA

Jim Thorpe boasts several reputable healthcare providers, and understanding their affiliations with various insurance plans is crucial. Knowing which hospitals and doctors participate in your chosen plan prevents unexpected out-of-network charges. Researching the network participation of local healthcare facilities before selecting a plan ensures a seamless healthcare experience in Jim Thorpe.

Understanding Deductibles, Co-pays, and Out-of-Pocket Maximums

The terms deductible, co-pay, and out-of-pocket maximum are often confusing, but they are critical components of understanding your health insurance costs in Jim Thorpe. Your deductible is the amount you pay out-of-pocket before your insurance starts covering costs. Co-pays are fixed amounts you pay for each doctor’s visit or prescription. The out-of-pocket maximum represents the total amount you’ll pay in a given year, after which your insurance covers 100% of your costs. Understanding these terms will help you budget for healthcare expenses and choose a plan that aligns with your financial capacity.

The Importance of Preventative Care in Jim Thorpe

Preventative care is often overlooked, but it’s a cornerstone of maintaining good health and managing healthcare costs in Jim Thorpe. Many insurance plans cover preventative services like annual checkups and screenings at no cost to you. Taking advantage of these services can prevent costly health issues down the line. Regular checkups and screenings can catch potential problems early, leading to more effective and less expensive treatment. Proactive healthcare management can result in significant long-term savings.

Marlon Stephenson Health Insurance: Your Local Jim Thorpe Expert

Navigating the complexities of health insurance in Jim Thorpe can be daunting. That’s where Marlon Stephenson comes in. With his years of experience and deep understanding of the local healthcare landscape, Marlon can help you find a plan that perfectly suits your needs and budget. He provides personalized guidance, ensuring you understand every aspect of your chosen plan. Partnering with Marlon simplifies the often overwhelming process of choosing health insurance.

Personalized Guidance for Jim Thorpe Residents

Marlon Stephenson doesn’t just sell insurance; he builds relationships. He takes the time to understand your unique circumstances and health history. This personalized approach ensures that you receive the most appropriate and cost-effective coverage for your needs within Jim Thorpe. His commitment to client satisfaction and detailed explanations make the process of choosing insurance less stressful and more empowering.

Streamlined Enrollment Process in Jim Thorpe

Marlon Stephenson simplifies the enrollment process, handling the paperwork and navigating the complexities of insurance applications. His expertise ensures a smooth and efficient process, saving you time and reducing the stress associated with navigating the often-confusing world of health insurance in Jim Thorpe. His dedication to streamlining the enrollment process ensures a hassle-free transition to your new health insurance plan.

Frequently Asked Questions about Health Insurance in Jim Thorpe, PA

Choosing the right health insurance plan in Jim Thorpe can be confusing. Here are answers to some frequently asked questions to help you navigate the process.

**What are the best health insurance plans available in Jim Thorpe?**

The “best” plan depends on your individual needs and budget. Marlon Stephenson can help you assess your circumstances and recommend plans that fit your lifestyle and healthcare requirements within Jim Thorpe. He will compare various plans, explaining the nuances of each to help you make an informed decision.

**How much will my health insurance cost in Jim Thorpe?**

The cost varies greatly based on the plan you choose, your age, and your health status. Marlon Stephenson can provide a detailed cost analysis of different plans to help you understand your potential financial obligations. He helps you find plans that align with your budget and ensure financial security.

**What documents do I need to apply for health insurance in Jim Thorpe?**

Generally, you’ll need personal identification, proof of income, and information about your dependents. Marlon Stephenson will guide you through the required documents and ensure you have everything needed for a seamless application process. He’ll provide detailed instructions and support throughout the application.

**What if I have a pre-existing condition?**

The Affordable Care Act protects individuals with pre-existing conditions. Marlon Stephenson will ensure you understand your rights and help you find a plan that adequately covers your healthcare needs, regardless of pre-existing conditions. He is an expert in navigating this aspect of health insurance.

**What if I need to change my health insurance plan?**

You can typically change your plan during open enrollment periods. Marlon Stephenson can assist you with switching plans, ensuring a smooth transition and minimizing any potential disruptions to your healthcare coverage. He’ll guide you through the entire process.

Conclusion

Choosing the right health insurance in Jim Thorpe, Pennsylvania is a critical decision. By understanding your needs, exploring local healthcare providers, and working with an experienced professional like Marlon Stephenson, you can navigate the complexities of health insurance with confidence and find the plan that best meets your requirements.