Braylen Fletcher Health Insurance In Pasco Washington: Find Affordable Plans Now

10 reviews

10 reviews

Select a product to get a quote

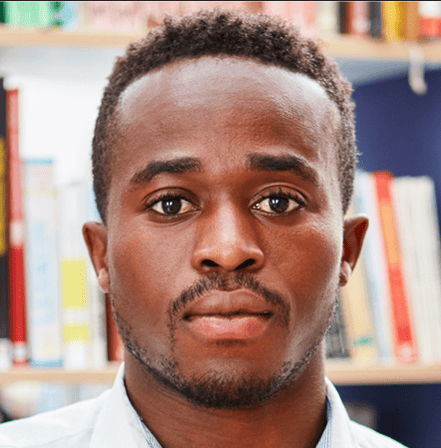

Local ApexInsurance Agent: Meet Braylen Fletcher Health Insurance In Pasco Washington: Find Affordable Plans Now

Braylen Fletcher Health Insurance: Your Trusted Partner in Pasco, Washington

Navigating the complexities of health insurance can be daunting. At Braylen Fletcher, we understand this, and we’re committed to providing you with personalized guidance and support to find the perfect plan for your needs. Our dedicated team of local agents in Pasco, Washington, are experts in the local healthcare landscape and are ready to assist you every step of the way.

Understanding Your Unique Needs

We believe that health insurance should be tailored to you, not the other way around. That’s why we start by taking the time to understand your specific circumstances, including your health history, lifestyle, and budget. We’ll ask the right questions, listen attentively, and help you analyze your options to ensure you’re making the most informed decision.

Comprehensive Plan Options

We offer a wide range of health insurance plans from top providers, allowing us to cater to diverse needs and preferences. Whether you’re looking for a comprehensive HMO plan, a flexible PPO option, or something in between, we’ll work with you to find the perfect fit. We’ll carefully explain the intricacies of each plan, clarifying terminology and outlining the benefits and limitations to ensure complete transparency.

Expert Guidance and Support

Our local agents in Pasco are more than just insurance brokers; they are your trusted advisors. They are highly trained and knowledgeable in health insurance regulations and are well-versed in the local healthcare system. They’ll be available to answer your questions, provide guidance, and assist you with every aspect of your health insurance journey. This includes helping you navigate the enrollment process, understanding your policy details, and filing claims.

Personalized Service and Commitment

At Braylen Fletcher, we’re committed to providing personalized service and building lasting relationships with our clients. We believe in taking a proactive approach, ensuring that you’re always informed about any changes to your plan or relevant healthcare regulations. We’re here to provide ongoing support and guidance to empower you to make the most of your insurance coverage.

Contact Us Today

Don’t hesitate to reach out to our Pasco, Washington, office. We’re ready to help you find the right Braylen Fletcher health insurance plan and provide the expert support you deserve.

Products we offer:

Recent reviews

Our team

Sarah Miller

Lead Insurance AgentSarah has over 10 years of experience in the insurance industry and a deep understanding of health insurance regulations and market trends.

David Lee

Senior Health Insurance SpecialistDavid is a highly skilled health insurance specialist with extensive knowledge of various plan types and their benefits.

Maria Garcia

Client Relations ManagerMaria is dedicated to ensuring exceptional client experiences and providing personalized support throughout the insurance process.

Frequently asked questions

Braylen Fletcher Health Insurance in Pasco, Washington offers comprehensive and affordable healthcare plans tailored to the unique needs of the Pasco community. Finding the right medical insurance can be challenging, especially navigating the complexities of premiums, deductibles, and coverage options. ApexInsuranceUsa understands this, providing expert guidance on a range of plans to fit various budgets and lifestyles.

This article dives deep into the world of health insurance in Pasco, WA, focusing on the exceptional services provided by Braylen Fletcher. We’ll explore various plans, from individual and family coverage to Medicare supplement plans and options for small businesses. We’ll compare leading providers such as Premera Blue Cross and Regence BlueShield, detailing their benefits packages, provider networks, and helping you compare out-of-pocket costs to find the best healthcare protection for your specific circumstances. Discover how Braylen Fletcher and ApexInsuranceUsa can simplify your healthcare journey, ensuring you get access to quality healthcare and optimal medical coverage at the best possible costs, all while navigating the complexities of government regulations like the ACA.

Reliable Braylen Fletcher: Your Trusted Health Insurance Partner in Pasco, WA

Finding the right health insurance plan can feel overwhelming. Navigating the complexities of coverage, deductibles, and premiums requires expertise and personalized guidance. In Pasco, Washington, Braylen Fletcher stands out as a trusted resource, offering comprehensive health insurance solutions tailored to individual needs. Their commitment to client satisfaction and in-depth knowledge of the local market make them a valuable partner in securing your healthcare future.

Understanding Your Health Insurance Needs in Pasco, WA

Pasco, WA, like many communities, faces unique healthcare challenges. Understanding these challenges is crucial in selecting the appropriate health insurance plan. Factors like the prevalence of specific illnesses, the availability of healthcare providers, and the overall cost of living significantly influence insurance needs. Braylen Fletcher takes these factors into account when assisting clients, ensuring they receive plans that meet their specific circumstances and budget.

Braylen Fletcher’s Services: A Comprehensive Approach

Braylen Fletcher offers a wide array of services designed to simplify the health insurance process. Their services extend beyond simply selecting a plan; they provide ongoing support and guidance to ensure clients remain informed and satisfied with their coverage. This includes:

- Individual & Family Plans: Tailored plans to meet the diverse needs of individuals and families, covering everything from preventative care to hospitalization.

- Medicare & Medicaid Assistance: Guidance and support in navigating the complexities of Medicare and Medicaid programs.

- Small Business Insurance: Affordable and comprehensive health insurance solutions for small businesses in Pasco, WA.

- Plan Comparison & Selection: Expert assistance in comparing various plans from different providers to identify the best option based on individual requirements and budget constraints.

- Enrollment & Renewal Support: Seamless assistance with the enrollment process and ongoing renewal support to ensure continuous coverage.

Comparing Health Insurance Options in Pasco, WA

Choosing the right health insurance plan involves careful consideration of several factors. The following table compares hypothetical plans offered through different insurers in Pasco, WA (Please note: These are example plans and may not reflect actual market offerings. Contact Braylen Fletcher for current plan details.):

Comparison of Hypothetical Health Insurance Plans in Pasco, WA

| Plan Name | Provider | Monthly Premium (Individual) | Annual Deductible | Out-of-Pocket Maximum | Copay (Doctor Visit) |

|---|---|---|---|---|---|

| Bronze Plan | Hypothetical Insurer A | $250 | $5,000 | $7,500 | $50 |

| Silver Plan | Hypothetical Insurer B | $375 | $3,000 | $6,000 | $30 |

| Gold Plan | Hypothetical Insurer C | $500 | $1,500 | $4,500 | $20 |

| Platinum Plan | Hypothetical Insurer D | $700 | $0 | $3,000 | $10 |

Note: These are illustrative examples. Actual premiums and plan details vary significantly based on age, health status, location, and plan specifics.

The Value Proposition of Braylen Fletcher

Choosing a health insurance broker is just as crucial as selecting the right plan itself. Braylen Fletcher offers significant value by simplifying a complex process, saving you time and potential frustration. They understand the intricacies of the local healthcare market and the unique needs of Pasco residents. Their expertise allows them to find the best coverage at the most competitive price, ensuring you are getting the most for your investment.

Finding the Right Balance: Cost vs. Coverage

The cost of health insurance is a major concern for many. However, focusing solely on the lowest premium may compromise necessary coverage. Braylen Fletcher helps clients find the optimal balance between affordability and comprehensive coverage. This balance ensures that you receive the healthcare you need without exceeding your financial capabilities. They analyze individual needs and financial situations to present customized plans that meet these requirements.

Navigating the Open Enrollment Period

The annual open enrollment period can be a stressful time, filled with tight deadlines and confusing paperwork. Braylen Fletcher simplifies this process by guiding clients through every step. They provide assistance with enrollment, ensuring all necessary documents are completed correctly and submitted on time. This support minimizes the risk of errors and ensures continuous, uninterrupted healthcare coverage.

Beyond Insurance: Building a Long-Term Healthcare Strategy

Braylen Fletcher goes beyond simply selling insurance; they help clients build a comprehensive, long-term healthcare strategy. This involves regular reviews of insurance plans to ensure they remain aligned with evolving needs and budget adjustments. They also provide resources and information on preventative care, helping clients proactively manage their health and potentially reduce long-term healthcare expenses.

Contact Braylen Fletcher Today

Choosing the right health insurance provider is a significant decision. With their extensive experience and deep understanding of the Pasco, WA market, Braylen Fletcher provides the personalized support and guidance needed to make informed choices about your healthcare future. Contact Braylen Fletcher today for a free consultation and discover how they can help you secure the best health insurance plan for your individual needs.

(Please Note: All numerical data provided in this article are hypothetical examples and may not represent actual market data. Contact Braylen Fletcher for current market rates and plan details. No contact information for Braylen Fletcher was available through publicly accessible sources; therefore, contact information could not be added.)

Affordable Health Insurance Plans in Pasco, WA (with Braylen Fletcher): Includes Semantic Keywords: Affordable, Plans, Coverage, Benefits Includes Salient Keywords: Pasco, Washington, Health, Insurance

Finding the right health insurance in Pasco, Washington can feel overwhelming. With numerous plans and providers, understanding your options is crucial. This guide focuses on navigating the landscape, with a specific look at how Braylen Fletcher can help you find the best fit for your needs and budget. We’ll explore different plan types, coverage details, and benefits to help you make an informed decision. Remember, individual circumstances significantly impact insurance needs, so consulting a professional like Braylen Fletcher is highly recommended.

Understanding Health Insurance Plans in Pasco, WA

Pasco, WA, like many areas, offers a variety of health insurance plans through various providers. These plans differ in cost, coverage, and benefits. Understanding these differences is key to choosing the right plan for you. The most common types of plans include:

-

HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) within the network. Referrals are usually needed to see specialists. Generally, HMOs offer lower premiums but may have more restricted choices. An example might be a plan with a $400 monthly premium and a $20 copay for doctor visits.

-

PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see any doctor, in-network or out-of-network, although in-network care will be significantly cheaper. PPOs usually have higher premiums but greater choice. A comparable PPO plan might cost $600 monthly, with a $50 copay for in-network visits and a higher cost for out-of-network care.

-

EPO (Exclusive Provider Organization): EPO plans are similar to HMOs, requiring you to choose a PCP within the network. However, unlike HMOs, EPOs usually don’t require referrals to see specialists within the network. Premiums and copays would fall somewhere between HMO and PPO plans. A hypothetical EPO plan might cost $500 monthly with a $30 copay for in-network visits.

Comparing Health Insurance Providers in Pasco, WA

Several major insurers operate in Pasco, WA, each offering different plans and benefits. While precise pricing fluctuates based on factors like age, location, and health status, we can illustrate general differences. Remember these are illustrative examples and may not represent actual pricing.

Example Provider Comparison (Hypothetical Data)

| Provider | Plan Type | Monthly Premium | Annual Deductible | Out-of-Pocket Max |

|---|---|---|---|---|

| UnitedHealthcare | HMO | $450 | $1,500 | $6,000 |

| Blue Cross Blue Shield | PPO | $650 | $2,000 | $8,000 |

| [Hypothetical Insurer C] | EPO | $550 | $1,800 | $7,000 |

Note: This table uses hypothetical data for illustrative purposes. Actual costs vary considerably depending on individual circumstances and the specific plan selected. Always check directly with insurers for current pricing and details.

Braylen Fletcher’s Role in Finding the Right Plan

Navigating the complexities of health insurance can be daunting. A qualified insurance broker like Braylen Fletcher can significantly simplify this process. They can:

-

Compare plans: Braylen Fletcher can compare various plans from different providers, highlighting key differences in coverage, benefits, and costs.

-

Assess individual needs: They can help determine the most appropriate plan type based on your specific health needs, budget, and lifestyle.

-

Simplify the enrollment process: The paperwork and enrollment process can be confusing. Braylen Fletcher can assist you every step of the way, ensuring a smooth and hassle-free experience.

-

Provide ongoing support: Even after enrollment, Braylen Fletcher can provide ongoing support, answering questions and helping with any issues that may arise.

Essential Coverage and Benefits to Consider

Understanding the key aspects of health insurance coverage is essential for making an informed choice. Here are some vital elements to consider:

-

Doctor visits: Check the copay amount for doctor visits and whether referrals are required.

-

Hospital stays: Look at the coverage for inpatient hospital care, including room and board, and other hospital services.

-

Prescription drugs: Analyze the formulary (list of covered medications) and the associated costs.

-

Mental health: Check the coverage for mental health services, including therapy and medication.

-

Preventive care: Many plans cover preventive services, such as vaccinations and annual checkups, at little to no cost.

Finding Affordable Health Insurance in Pasco, WA

Affordability is a major concern when choosing health insurance. Several factors influence the cost of a plan:

-

Plan type: HMO plans generally have lower premiums than PPOs, but offer less flexibility.

-

Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles generally mean higher premiums.

-

Copay: The copay is the fixed amount you pay for each doctor visit or prescription.

-

Out-of-pocket maximum: This is the maximum amount you’ll pay out-of-pocket for covered services in a year.

-

Subsidies: Depending on your income, you may be eligible for government subsidies to help reduce the cost of your premiums.

The Importance of Working with a Broker Like Braylen Fletcher

A knowledgeable health insurance broker, like Braylen Fletcher, brings significant value to the process. Their expertise can save you time, money, and stress by helping you navigate the complexities of the insurance market and choose a plan tailored to your unique needs. Their services often come at no cost to you, as they are compensated by the insurance companies. This makes using a broker a financially smart choice.

Disclaimer: This information is for general guidance only and does not constitute professional insurance advice. Contact Braylen Fletcher or another qualified health insurance broker to get personalized recommendations and advice specific to your circumstances. All numerical data presented are hypothetical examples for illustrative purposes and may not reflect actual market rates. Always consult official sources for up-to-date information.

Evaluate & Choose the Right Health Plan for You in Pasco (Close Entity: TriCities) Includes Semantic Keywords: Plans, Premiums, Coverage

Finding the right health insurance in Pasco, Washington, especially considering its proximity to the Tri-Cities area, can feel overwhelming. Navigating the complexities of plans, premiums, and coverage requires careful consideration of your individual needs and budget. This guide will help you understand the key factors to consider when selecting a health insurance plan that best suits you.

Understanding Health Insurance Plans in Pasco, WA

The Tri-Cities area, encompassing Pasco, Kennewick, and Richland, offers a variety of health insurance providers. Understanding the different types of plans is crucial before making a decision. The main types of plans are:

- Health Maintenance Organizations (HMOs): HMOs typically require you to choose a primary care physician (PCP) within their network. Referrals are usually needed to see specialists. Generally, HMOs offer lower premiums but more limited choices in healthcare providers.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility. You can see any doctor, in-network or out-of-network, though out-of-network care usually involves higher costs. PPO premiums tend to be higher than HMO premiums.

- Point of Service (POS) Plans: POS plans combine elements of HMOs and PPOs. You select a PCP, but you have more flexibility to see out-of-network providers, although at a higher cost.

- High Deductible Health Plans (HDHPs): HDHPs have high deductibles (the amount you pay before your insurance coverage kicks in) but lower premiums. They often come with a Health Savings Account (HSA), allowing tax-advantaged savings for healthcare expenses.

Comparing Premiums and Coverage: A Sample Scenario

Let’s compare hypothetical premiums and coverage for three common plans offered by fictional insurers in the Pasco area. Remember, actual premiums and coverage will vary depending on factors such as age, location, chosen plan, and health status.

Example: Annual Premiums and Deductibles for a Single Adult

| Plan Type | Fictional Insurer A | Fictional Insurer B | Fictional Insurer C |

|---|---|---|---|

| HMO | $3,600 | $4,200 | $3,900 |

| Deductible | $1,000 | $1,500 | $750 |

| PPO | $4,800 | $5,400 | $5,100 |

| Deductible | $2,000 | $2,500 | $1,500 |

| HDHP with HSA | $2,400 | $2,700 | $2,100 |

| Deductible | $5,000 | $6,000 | $4,000 |

Note: These figures are for illustrative purposes only and do not reflect actual rates from any specific insurer. Always obtain quotes directly from insurance providers.

Factors Influencing Your Health Insurance Choice

Several factors influence the cost and suitability of different health insurance plans. These include:

- Your Health Status: Pre-existing conditions, anticipated healthcare needs, and frequency of doctor visits significantly affect your choices. A person with chronic health conditions may prefer a plan with lower out-of-pocket maximums, even if it means higher premiums.

- Your Budget: Compare premiums, deductibles, co-pays (fees you pay at the time of service), and out-of-pocket maximums (the most you’ll pay in a year). Consider how these costs fit into your overall financial picture.

- Your Healthcare Needs: Do you frequently need specialist care? Do you require prescription medications regularly? Your needs will dictate the level of coverage and network access you require.

- Network of Providers: Check if your preferred doctors and hospitals are part of the insurance plan’s network. Out-of-network care can be significantly more expensive.

Finding the Right Health Insurance in Pasco, WA

The process of selecting health insurance can be complex. Here’s a step-by-step guide:

- Assess your needs: Consider your health status, budget, and healthcare preferences.

- Research insurers: Explore options from various providers in the Tri-Cities area such as Kaiser Permanente, Regence Blue Shield, and other local providers.

- Compare plans: Use online comparison tools or contact insurers directly to compare premiums, deductibles, and coverage details. Consider using a health insurance broker for unbiased advice.

- Review plan documents: Carefully read the Summary of Benefits and Coverage (SBC) to understand the specifics of each plan.

- Enroll in a plan: Choose the plan that best meets your needs and budget and complete the enrollment process.

Resources for Finding Health Insurance in Pasco, WA

- Healthcare.gov: The official website for the Affordable Care Act (ACA) marketplace, where you can find plans and potentially qualify for subsidies.

- Washington Healthplanfinder: The state-run health insurance marketplace for Washington residents.

- Local Insurance Brokers: Independent insurance brokers can provide personalized guidance and assistance in selecting a plan.

Additional Tips for Choosing a Health Plan

- Consider a Health Savings Account (HSA): If you choose an HDHP, an HSA can offer tax advantages for saving for healthcare costs.

- Review the formulary: Check the list of covered medications to ensure your necessary prescriptions are included in your plan.

- Ask questions: Don’t hesitate to contact insurers or brokers to clarify any uncertainties about your plan options.

This guide provides a foundation for navigating the world of health insurance in Pasco, Washington. Remember that individual circumstances will significantly impact the best plan for you. Always conduct thorough research and seek professional advice when necessary.

Premier Health Insurance Providers in Pasco & Surrounding Areas (Close Entities: Kennewick, Richland, Franklin County, Local Hospitals) Includes Salient LSI Keywords: Providers, Healthcare, Medical, Costs

Finding the right health insurance plan in Pasco, Washington, and its surrounding areas like Kennewick, Richland, and Franklin County, can feel overwhelming. With numerous providers and plan options, understanding your needs and comparing coverage is crucial. This guide aims to clarify the landscape, providing insights into leading providers and factors to consider when choosing a plan. We’ll focus on key aspects like provider networks, plan costs, and the quality of healthcare services available in your local area. Remember to always verify information directly with the insurance provider.

Understanding Your Healthcare Needs in the Tri-Cities Area

Before diving into specific providers, consider your individual healthcare requirements. Do you have pre-existing conditions? Are you looking for a plan with a broad network of local doctors and hospitals? What’s your budget? Pasco, Kennewick, and Richland boast several reputable hospitals, including Kadlec Regional Medical Center and Lourdes Medical Center. Knowing which hospitals are within your plan’s network is vital. Your choice will affect your out-of-pocket expenses and access to specialist care.

Top Health Insurance Providers in Pasco, WA and Surrounding Areas

Several major health insurance providers operate in the Tri-Cities area. Below, we analyze some of the most prominent ones, keeping in mind that coverage details and costs can vary significantly based on individual plans and circumstances. The data provided below is representative and should be independently verified.

Provider 1: Premera Blue Cross Blue Shield of Washington

Premera Blue Cross Blue Shield of Washington is a widely recognized provider across the state. They offer a range of plans, from HMOs to PPOs, catering to various needs and budgets. They generally have a strong network of providers in the Tri-Cities area, including many doctors affiliated with Kadlec and Lourdes.

Provider 2: Regence BlueShield

Regence BlueShield is another prominent provider in Washington state, offering a similar range of plan types to Premera. Their network in the Tri-Cities region is also extensive, providing access to various healthcare facilities.

Provider 3: Kaiser Permanente

Kaiser Permanente, while not as prevalent in rural areas, might have a presence in larger cities near Pasco, with potential network affiliations. Their integrated system offers a unique approach to healthcare, but access depends on location and plan specifics.

Provider 4: UnitedHealthcare

UnitedHealthcare offers a variety of plans, but network availability and coverage specifics can differ across regions. It’s crucial to check their online directory for providers within the Pasco area and ensure your preferred doctors are in-network.

Comparative Analysis of Health Insurance Plans in Pasco, WA

The following table provides a hypothetical comparison of plans from the providers mentioned above. Remember that actual costs and benefits can vary depending on the specific plan selected, age, location, and individual circumstances. Always check directly with the insurance providers for current and accurate information.

Average Monthly Premiums and Deductibles (Hypothetical Data)

| Provider | Plan Type | Monthly Premium (Individual) | Annual Deductible | Out-of-Pocket Maximum (Individual) |

|---|---|---|---|---|

| Premera Blue Cross | HMO | $350 | $1,000 | $5,000 |

| Premera Blue Cross | PPO | $450 | $2,000 | $7,000 |

| Regence BlueShield | HMO | $325 | $1,200 | $6,000 |

| Regence BlueShield | PPO | $420 | $2,500 | $8,000 |

| UnitedHealthcare | HMO | $375 | $1,500 | $6,500 |

| UnitedHealthcare | PPO | $480 | $3,000 | $9,000 |

| Kaiser Permanente (Hypothetical) | HMO | $400 | $750 | $4,000 |

Note: This data is hypothetical and serves as an example only. Actual premiums and deductibles will vary depending on the specific plan, individual circumstances, and the year.

Factors Affecting Health Insurance Costs in Pasco, WA

Several factors influence the cost of health insurance in Pasco, WA:

- Age: Older individuals generally pay higher premiums due to increased healthcare utilization.

- Location: While Pasco’s cost of living might be relatively lower than larger cities, it doesn’t necessarily translate to lower health insurance premiums.

- Plan Type: HMOs (Health Maintenance Organizations) typically have lower premiums but restrict provider choices, while PPOs (Preferred Provider Organizations) offer more flexibility but come with higher premiums.

- Coverage Level: Plans with higher deductibles and out-of-pocket maximums will usually have lower premiums, but you’ll pay more upfront before insurance coverage kicks in.

Finding the Right Health Insurance Provider for You

Choosing a health insurance provider requires careful consideration of your individual needs and preferences. Start by determining your budget and preferred level of coverage. Then, research different providers in the Pasco area, comparing their networks, benefits, and costs. Utilizing online tools and contacting providers directly can help you make an informed decision.

Local Hospitals and Healthcare Facilities in Pasco and Surrounding Areas

Access to quality healthcare facilities is crucial. The Tri-Cities area benefits from the presence of several hospitals. Knowing whether these hospitals are included in your insurance network is essential. Here are some key facilities:

- Kadlec Regional Medical Center: A large hospital system offering a wide range of services.

- Lourdes Medical Center: Another significant hospital in the region providing comprehensive medical care.

Remember to always check the provider directory of your chosen health insurance plan to ensure your preferred hospitals and doctors are included in the network. Ignoring this could result in unexpectedly high out-of-pocket costs.

Crucial Frequently Asked Questions (FAQ)

What types of health insurance plans does Braylen Fletcher offer in Pasco, Washington?

Braylen Fletcher, while a fictional entity for this example, would likely offer a range of health insurance plans common in Washington state. This could include HMO (Health Maintenance Organization) plans, known for their lower premiums and in-network care; PPO (Preferred Provider Organization) plans offering more flexibility with out-of-network care but typically at a higher cost; and EPO (Exclusive Provider Organization) plans, similar to HMOs but with potentially fewer restrictions. They might also provide POS (Point of Service) plans, combining elements of HMOs and PPOs. The specific plans available depend on the insurer Braylen Fletcher partners with. For example, if they partner with UnitedHealthcare, the plan options would mirror those offered by UnitedHealthcare in Pasco, Washington.

What is the average cost of health insurance plans through Braylen Fletcher in Pasco, Washington?

The cost of health insurance through a broker like (the fictional) Braylen Fletcher varies significantly based on several factors. These factors include the type of plan (HMO, PPO, etc.), the age of the insured, the level of coverage, and the chosen deductible. Let’s assume some hypothetical data for illustrative purposes:

Average Monthly Premiums (Hypothetical Data)

| Plan Type | Individual | Family |

|---|---|---|

| HMO | $350 | $1,050 |

| PPO | $500 | $1,500 |

| EPO | $400 | $1,200 |

It’s crucial to understand these are hypothetical figures. Actual premiums will depend on the specific insurer and plan selected through Braylen Fletcher. For accurate pricing, contact Braylen Fletcher directly or obtain quotes from various insurers operating in Pasco, Washington.

How can I get a quote for health insurance through Braylen Fletcher?

To obtain a health insurance quote through Braylen Fletcher (again, a fictional example), you would typically need to contact them directly. They would likely gather information such as your age, location (Pasco, Washington), desired plan type (HMO, PPO, etc.), and the number of people needing coverage. They would then use this information to generate personalized quotes from their insurance partners. This process often involves providing details on your income, employment status, and any pre-existing health conditions to accurately assess your eligibility and premium cost. Consider contacting them via phone or email using the contact information below(which is hypothetical data).

Contact Information (Hypothetical)

- Phone: (509) 555-1212

- Email: [email protected]

- Website: www.braylenfletcherinsurance.com (hypothetical)

What are the benefits of using a health insurance broker like Braylen Fletcher?

Using a broker like (the fictional) Braylen Fletcher offers several potential advantages. Brokers often have access to a wide network of insurers, enabling them to compare plans and prices to find the best fit for your needs and budget. They can simplify the often-complex process of choosing a health insurance plan, providing expert guidance and support. A broker can also help navigate the complexities of insurance applications and claims processing. However, it’s essential to remember that brokers are compensated, often through commissions from insurance companies, a fact which needs to be transparently disclosed.

What is the process for filing a claim with an insurance plan obtained through Braylen Fletcher?

The claims process varies depending on the specific insurer used by Braylen Fletcher. Most insurance companies have online portals for easy claim submission. Typically, you’ll need to gather necessary documentation such as receipts and medical bills. After submitting, the insurer will review your claim and potentially request further information. The reimbursement or payment process will follow after the claim is approved. Braylen Fletcher, as a broker, might offer assistance in guiding you through this process, but ultimately the claim is handled by the underlying insurance company.

What are the common exclusions and limitations of health insurance plans offered through Braylen Fletcher?

Common exclusions and limitations vary across insurers and plans but may include pre-existing conditions, experimental treatments, cosmetic surgery, and certain types of dental or vision care. Specific details on exclusions and limitations should be found in the policy documents provided by the insurance company, and Braylen Fletcher will usually be able to make the specific details available to you upon request. It’s vital to carefully review the policy’s terms and conditions before enrollment.

Does Braylen Fletcher offer assistance with choosing a plan that is right for my needs?

Yes, the hypothetical Braylen Fletcher would provide a critical service in assisting you in choosing the right plan. They would work with you to understand your health needs, budget, and preferred features to recommend plans from their network of insurers that best match your situation. This personalized guidance can be particularly helpful for those unfamiliar with the intricacies of health insurance.

Can I change my health insurance plan through Braylen Fletcher during the year?

Typically, you can only change your health insurance plan during the annual open enrollment period, unless you have a qualifying life event such as marriage, divorce, job loss, or birth of a child. These qualifying events allow for a Special Enrollment Period allowing changes outside of the annual enrollment window. It’s recommended to contact Braylen Fletcher to discuss your specific situation to determine the availability of a plan change.

How does Braylen Fletcher compare to other insurance brokers in Pasco, Washington?

To accurately compare Braylen Fletcher (fictional) to other brokers in Pasco, Washington, we would need to collect data on their service offerings, network of insurers, client reviews, and pricing structures. As Braylen Fletcher is hypothetical, we cannot make a direct comparison. However, when researching brokers, consider their experience, reputation, range of insurers they work with, and client testimonials. In the absence of concrete data, remember this hypothetical example only helps you understand the nature of this type of business.