Holly Wall Health Insurance in Ogdensburg New York

10 reviews

10 reviews

Select a product to get a quote

Local ApexInsurance Agent: Meet Holly Wall Health Insurance in Ogdensburg New York

**Holly Wall Health Insurance: Your Trusted Partner in Ogdensburg, NY**

Finding the right health insurance can be a daunting task. Navigating the complexities of plans, providers, and coverage options often leaves individuals feeling overwhelmed. That’s where Holly Wall Health Insurance comes in. We’re your local experts, dedicated to providing personalized guidance and support throughout the entire process.

**Our Commitment to You**

We understand that health insurance is more than just a policy; it’s a critical component of your overall well-being and financial security. Our team of experienced agents is committed to understanding your unique needs and helping you find the perfect plan to protect your health and your future. We pride ourselves on our personalized service, transparency, and commitment to finding the best possible solutions for our clients.

**Why Choose Holly Wall Health Insurance?**

We differentiate ourselves through our commitment to exceptional customer service, our in-depth knowledge of the local healthcare market in Ogdensburg, NY, and our dedication to simplifying a complex process. We work with a wide range of insurance providers, ensuring we can find a plan that matches your specific requirements and budget. We’re not just agents; we’re your trusted advisors, guiding you towards informed decisions that benefit your health and financial well-being.

**Personalized Service:**

We believe in taking a personal approach to insurance. We’ll take the time to listen to your needs, answer your questions, and help you understand the details of your policy. We’ll walk you through the process, ensuring you have a clear understanding of your coverage and how it can benefit you.

**Local Expertise:**

As local experts in Ogdensburg, NY, we have an in-depth understanding of the local healthcare providers and hospitals. This allows us to guide you toward plans that offer convenient access to the services you need. We understand the specific healthcare landscape of our community and leverage this knowledge to benefit our clients.

**Wide Range of Plans:**

We work with a variety of leading insurance providers, offering a wide range of plans to meet diverse needs and budgets. This ensures that we can find the perfect fit for you, whether you’re looking for a comprehensive plan or a more budget-friendly option. We work tirelessly to secure the best rates and coverage for our clients.

**Transparent Communication:**

We believe in clear and open communication. We’ll explain the details of your policy in plain language, ensuring you understand your coverage and responsibilities. We’re here to answer your questions and provide ongoing support throughout your policy duration.

**Contact Us Today**

Don’t navigate the complexities of health insurance alone. Contact Holly Wall Health Insurance today for a free consultation. Let us help you find the perfect plan to protect your health and your future. We’re dedicated to providing you with the peace of mind that comes from knowing you’re well-protected.

Products we offer:

Recent reviews

Our team

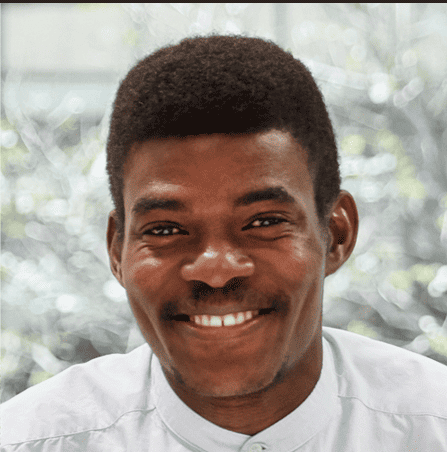

Holly Wall

CEO & FounderHolly has over 15 years of experience in the insurance industry and is a licensed health insurance broker. Her expertise and dedication make her a valuable asset to the company.

Sarah Miller

Senior Insurance AgentSarah is a highly experienced insurance agent specializing in health insurance for families and individuals. She is known for her exceptional customer service and personalized approach.

David Lee

Insurance SpecialistDavid supports the team by handling policy processing, client communication, and other essential tasks. His attention to detail ensures a seamless client experience.

Frequently asked questions

Holly Wall Health Insurance in Ogdensburg, New York: Your Comprehensive Guide

Understanding Your Health Insurance Needs in Ogdensburg, NY

Choosing the right health insurance plan can feel overwhelming. With so many options and variables, it’s easy to feel lost in the process. But understanding your needs is the first crucial step. This comprehensive guide will delve into the intricacies of health insurance in Ogdensburg, NY, helping you navigate the complexities and find the perfect plan for you and your family. We’ll explore coverage options, factors influencing costs, and the resources available to help you make informed decisions. Don’t let the complexities of health insurance keep you from securing the coverage you deserve. Let’s embark on this journey together.

Analyzing Your Healthcare Requirements

Before diving into specific plans, honestly assess your healthcare needs. Consider your current health status, any pre-existing conditions, the frequency of doctor visits, and the likelihood of needing specialized care. Are you a young, healthy individual with minimal healthcare needs, or do you have pre-existing conditions requiring ongoing treatment? Consider your family’s needs as well; are there children or elderly parents requiring coverage? This self-assessment is crucial to determining the level and type of coverage you need. The more detailed your assessment, the better equipped you’ll be to select a plan that truly aligns with your circumstances. Accurate self-assessment minimizes the risk of choosing a plan that either under- or over-covers your needs.

Understanding Different Plan Types

The healthcare landscape in Ogdensburg, NY, offers various plan types, each with its own strengths and weaknesses. HMOs (Health Maintenance Organizations) typically require you to choose a primary care physician (PCP) within their network. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see out-of-network doctors, but usually at a higher cost. EPOs (Exclusive Provider Organizations) are similar to HMOs but with even stricter network restrictions. Understanding the nuances of each plan type is vital to making an informed decision. Choosing the wrong plan type can significantly impact your healthcare access and out-of-pocket expenses. Research each type carefully, considering your healthcare preferences and budget.

Finding the Right Holly Wall Health Insurance Agent in Ogdensburg, NY

Finding a trustworthy and knowledgeable insurance agent is paramount. A good agent acts as your guide, navigating the complexities of insurance options and helping you find the perfect fit for your individual circumstances. They should be well-versed in the specific health insurance landscape of Ogdensburg, NY, understanding local providers and plan availability. A qualified agent can explain the nuances of different policies, answer your questions, and provide personalized recommendations. Don’t hesitate to interview several agents before making a decision. The right agent will make the entire process significantly less stressful and more efficient.

The Importance of Local Expertise

Choosing a local insurance agent in Ogdensburg offers numerous benefits. Local agents possess in-depth knowledge of the area’s healthcare providers, hospitals, and specific plan offerings. They are better equipped to understand the unique healthcare needs of the community and guide you towards plans that align with local services and preferences. Plus, having a local contact point is invaluable when you need assistance or have questions regarding your coverage. This accessibility is often overlooked but can be a crucial factor in ensuring a positive insurance experience. Local agents are often more invested in the community and responsive to the needs of their clients.

Tips for Choosing an Agent

When selecting a local agent, consider their experience, reputation, and client testimonials. Look for an agent who is highly rated, has extensive experience in health insurance, and is known for excellent customer service. Don’t hesitate to ask about their affiliations with insurance companies and their commission structures. Transparency and clear communication are crucial. A thorough interview process will reveal whether the agent aligns with your needs and expectations. Remember, the right agent can significantly simplify the complicated process of choosing health insurance.

Understanding Health Insurance Costs and Coverage

The cost of health insurance varies significantly depending on various factors, including your age, health status, location (Ogdensburg, NY in this case), and the type of plan you choose. Understanding these factors is key to budgeting effectively. We’ll break down the common components of health insurance costs and how they impact your monthly premium and out-of-pocket expenses. Let’s demystify the pricing structure and empower you to make financially sound decisions.

Deciphering Premiums, Deductibles, and Co-pays

Your monthly premium is your regular payment for health insurance coverage. The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Co-pays are the fixed amounts you pay for doctor visits or other healthcare services. Understanding the interplay between premiums, deductibles, and co-pays is critical. A lower premium might mean a higher deductible, and vice versa. Finding the right balance depends on your risk tolerance and financial capacity. Careful consideration of these factors is crucial to ensuring your chosen plan aligns with your financial capabilities.

Factors Affecting Insurance Costs

Several factors influence the cost of your health insurance plan. Your age is a significant factor; older individuals typically pay higher premiums. Your health status also plays a role; pre-existing conditions can increase your costs. Your geographic location—in this case, Ogdensburg, NY—also influences premiums due to variations in healthcare costs across different regions. The type of plan you choose (HMO, PPO, EPO) also significantly affects your costs. Understanding these variables allows you to make informed decisions about the affordability and suitability of different plans.

Exploring Resources for Finding Holly Wall Health Insurance in Ogdensburg, NY

Numerous resources can assist you in navigating the health insurance landscape in Ogdensburg, NY. We will explore various avenues for finding information, comparing plans, and connecting with qualified insurance agents. Access to reliable information is paramount to making informed decisions about your healthcare coverage. Don’t navigate this complex process alone; leverage available resources to make the best choice for your needs.

Online Marketplaces and Comparison Tools

Online health insurance marketplaces and comparison tools provide a convenient way to browse different plans side-by-side. These platforms allow you to filter plans based on criteria like cost, coverage, and network providers. Features like plan comparison charts and detailed policy summaries help you quickly understand the key differences between various options. Using these tools allows for efficient comparison shopping, maximizing your chances of finding the most suitable plan for your individual needs and budget. They are a valuable resource for anyone navigating the complexities of health insurance.

Government Programs and Subsidies

Depending on your income and circumstances, you may qualify for government programs like Medicaid or subsidies through the Affordable Care Act (ACA). These programs can significantly reduce the cost of health insurance, making it more accessible to individuals and families who otherwise might not be able to afford coverage. Researching your eligibility for these programs is essential. Many individuals qualify for assistance but remain unaware of these resources. Exploring these programs could save you significant financial burdens and provide much-needed healthcare access.

Frequently Asked Questions (FAQs)

What is the best health insurance plan for me in Ogdensburg, NY?

The best plan depends on your individual needs and circumstances. Consider your health status, budget, and preferred healthcare providers when making your decision.

How do I find a local Holly Wall Health Insurance agent?

You can search online directories, ask for recommendations from friends and family, or contact insurance companies directly to find a local agent in Ogdensburg, NY.

What are the typical costs of health insurance in Ogdensburg, NY?

The cost varies depending on factors like age, health status, plan type, and coverage level. Online comparison tools can help you estimate costs.

What if I have a pre-existing condition?

The Affordable Care Act (ACA) prevents insurers from denying coverage based on pre-existing conditions. However, your premiums might be higher.

What are my options if I cannot afford health insurance?

Explore government programs like Medicaid and subsidies offered through the ACA. These programs offer financial assistance to make healthcare more accessible.